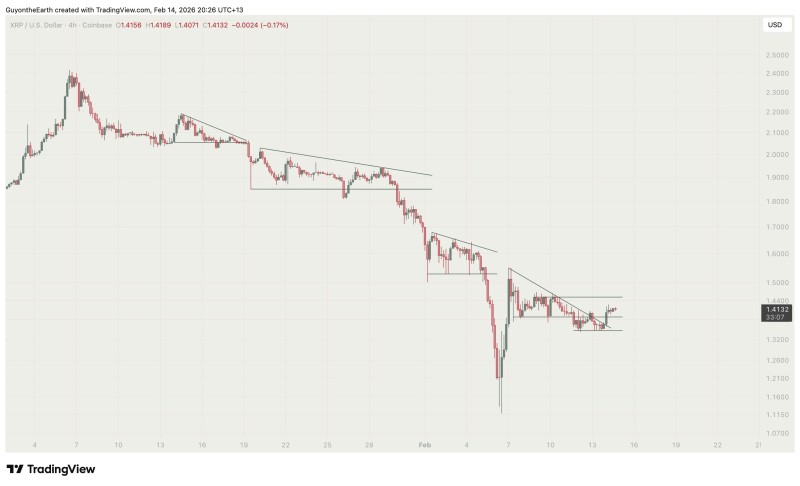

⬤ XRP has been trading sideways in a narrow range as its technical setup slowly strengthens, though there hasn't been a clear breakout yet. Pushing above $1.45 could kick off a bullish move, with $1.60 as the next likely target.

⬤ The chart reveals XRP forming a tightening pattern with reduced volatility following a broader pullback. Price is stuck beneath descending resistance while holding above mid-range support, which points to accumulation rather than a continuing downtrend. The $1.45 level is the key barrier to watch—it lines up with the top of the current consolidation channel.

⬤ Breaking through this resistance could send momentum rushing toward $1.60, as the analysis suggests. But until that happens, XRP remains trapped in range-bound action, caught between cautious buyers and uncertain sellers. As one analyst noted, "The market is transitioning rather than trending." This type of consolidation has shown up before in recent XRP resistance breakout setups and during broader XRP rally pauses, where price needed confirmation before making its next big move.

⬤ Right now, the structure hints at a shift in the works rather than a full-blown trend. A solid breakout would signal fresh directional conviction and possibly attract new buyers. On the flip side, if XRP fails at resistance, it'll likely stay locked in sideways chop until fresh demand steps in to shake things up.

⬤ For traders, the game plan is simple: watch $1.45 closely. A clean break above it opens the door to $1.60, while rejection keeps the range intact. Until then, patience is key as the market decides its next direction.

Peter Smith

Peter Smith

Peter Smith

Peter Smith