Ethereum (ETH) price action continues to dance to the rhythm of whale movements, and the latest data reveals a fascinating split among different whale tiers. While the crypto market watches for direction, these major holders are making moves that could determine ETH's next chapter. The divergence between mega whales and large whales tells a story of shifting market dynamics that every ETH investor should understand.

Ethereum Price Dynamics and Whale Movements

The numbers don't lie when it comes to whale influence on Ethereum's trajectory. Recent on-chain analysis shows just how dramatically these major players can move markets with their decisions.

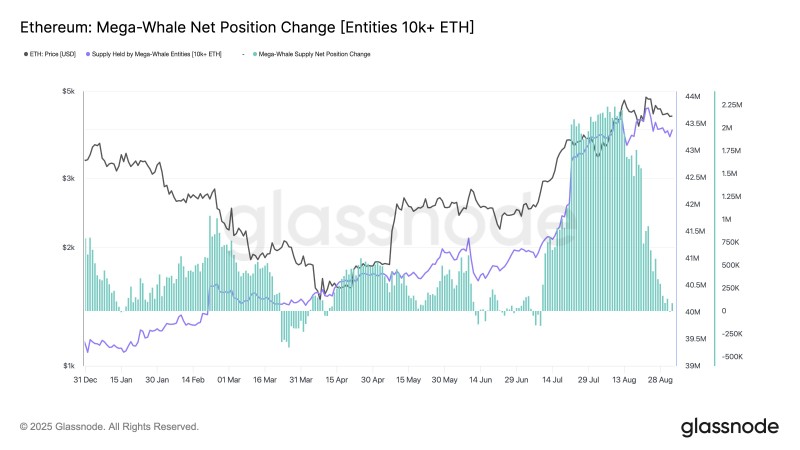

Analyst @CryptoUncle0x highlighted that mega whales holding 10,000+ ETH went on an unprecedented shopping spree in August, scooping up over 2.2 million ETH worth roughly $8 billion.

This massive accumulation helped fuel Ethereum's August rally and showed serious institutional-level confidence in the asset.

But here's where things get interesting – this buying frenzy has suddenly hit the brakes. These mega whales have essentially gone quiet, leaving the market wondering if they're satisfied with their positions or just taking a breather before the next wave of accumulation.

Large Whales Make Their Move

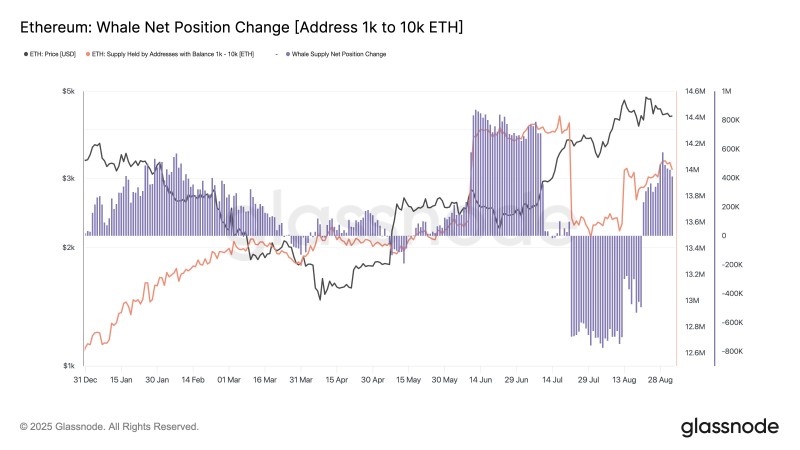

While the biggest fish have stepped back, a different group has entered the scene with renewed appetite. Large whales holding between 1,000 and 10,000 ETH had been selling through the summer, but they've completely flipped their strategy.

Over the past month, these large whales have accumulated approximately 411,000 ETH, showing they're not afraid to buy while others hesitate. This shift suggests these holders see value at current levels and are positioning for potential upside.

Market Implications and Price Outlook

This whale behavior split creates an interesting dynamic for ETH's price. The pause in mega whale buying removes a significant source of upward pressure that helped drive the August rally. Without these massive inflows, ETH might struggle to break through major resistance levels in the near term.

However, the renewed interest from large whales could provide crucial support. Their accumulation acts like a safety net, potentially preventing major selloffs and keeping ETH above key support zones. It's like having a new group of buyers ready to step in when others back away.

The big question is sustainability. If large whales continue their buying while mega whales remain sidelined, ETH could maintain stability even without the massive institutional flows. But if both groups decide to step back simultaneously, September could bring more volatility than many expect.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah