The cryptocurrency market has seen a dramatic shift in institutional investment patterns, with Ethereum emerging as the clear favorite among digital assets. Recent data reveals a stark contrast between investor sentiment toward Ethereum and Bitcoin, suggesting a potential changing of the guard in crypto investment strategies. This trend could have significant implications for both assets' future price movements and market positioning.

ETH Price Strengthens as Inflows Surge

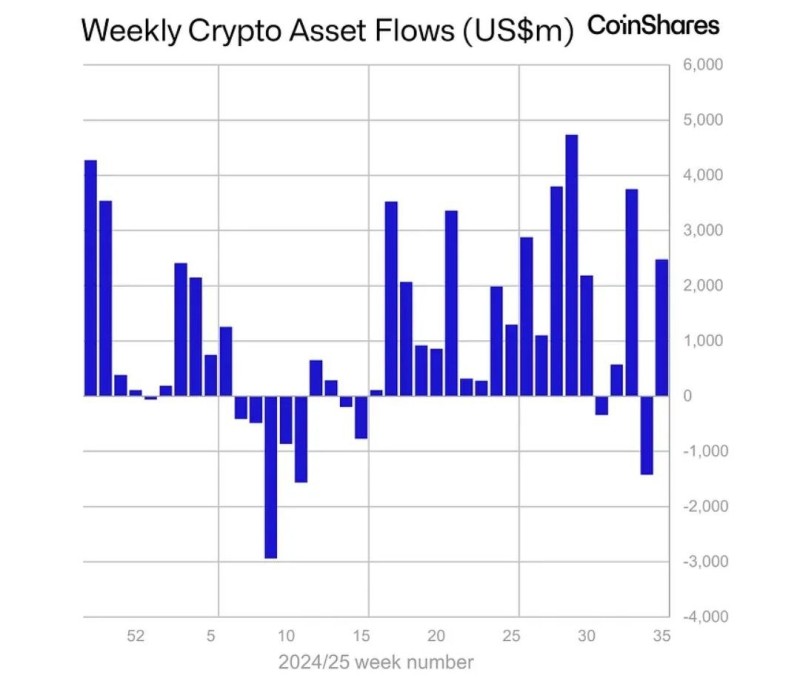

Last week marked a turning point for digital assets, with institutional money flowing back into the space in a big way. CoinShares reported $2.48 billion in total inflows, and Ethereum was the star of the show.

Trader @MartyXBT broke down the numbers, showing just how much investors are favoring ETH right now. Ethereum pulled in $1.4 billion in just one week, easily beating Bitcoin's $748 million. This shows that people are looking beyond Bitcoin's role as "digital gold" and getting excited about what Ethereum can actually do.

Ethereum vs. Bitcoin: Monthly Divergence

The August numbers tell an even more interesting story. While Ethereum racked up $3.95 billion in inflows for the month, Bitcoin actually lost $301 million to outflows - even with some positive weekly activity.

This split makes sense when you think about it. Investors are getting more interested in Ethereum's real-world applications like staking rewards, DeFi protocols, and tokenization features, while Bitcoin's main selling point remains being a store of value.

Market Context: Crypto Inflows Hit $4.37 Billion in August

August was a strong month overall for crypto, with $4.37 billion flowing into digital assets after some rough patches earlier. Ethereum dominated these inflows, while smaller altcoins picked up the scraps.

Many analysts think this money movement is tied to growing hopes around regulatory clarity and potential ETF approvals. This institutional shift toward ETH could be setting the stage for bigger price moves down the road.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah