The Ethereum (ETH) market is experiencing an intriguing shift in whale dynamics that could signal important changes ahead. While different whale categories typically move in similar patterns, recent data reveals a notable split in strategies between the largest and second-tier holders. This divergence offers valuable insights into market sentiment and potential price movements for ETH.

Ethereum Whales Show Conflicting Strategies

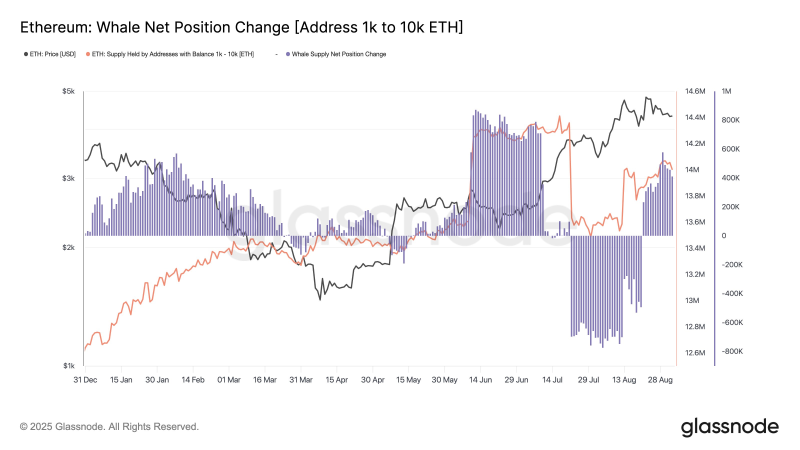

Mega whales controlling over 10,000 ETH each made headlines in August by accumulating an impressive 2.2 million ETH. However, these massive holders have since pulled back significantly from their aggressive buying spree. Famous analyst noted this shift, explaining that while mega whales seem to be adopting a wait-and-see approach, large whales in the 1,000-10,000 ETH range are doing the opposite.

After reducing their positions during August, these large whales have returned to the market with renewed enthusiasm. Their recent accumulation suggests they view current price levels as attractive entry points, contrasting sharply with the more cautious stance of their larger counterparts.

Market Sentiment Reflects Whale Uncertainty

This unusual split in whale behavior creates mixed signals for the broader Ethereum market. Mega whales' hesitation might stem from concerns about macroeconomic conditions or expectations of better buying opportunities ahead. Their massive holdings give them significant influence over market direction, making their cautious approach noteworthy.

Meanwhile, the aggressive accumulation by large whales indicates strong belief in Ethereum's fundamentals and future prospects. These holders often represent institutional investors and sophisticated traders who may be positioning for medium-term gains.

Price Implications and Trading Outlook

The contrasting whale strategies could lead to increased volatility as the market processes these mixed signals. If large whales continue their accumulation trend, ETH might experience upward pressure in the near term. However, the reluctance of mega whales to add to their positions could cap any major rallies.

This dynamic creates an interesting scenario where Ethereum's price action may depend on which whale category ultimately proves more influential. Traders should monitor these accumulation patterns closely, as they often serve as reliable indicators of future price movements. The current standoff between cautious mega whales and bullish large whales may continue until broader market conditions provide clearer direction.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah