Ethereum (ETH) staking landscape is experiencing unprecedented demand as investors rush to secure validator positions. This surge in staking activity comes at a time when the crypto market is showing signs of institutional maturation, with long-term holders increasingly viewing ETH as a yield-generating asset rather than just a speculative play.

Staking Demand Reaches New Heights

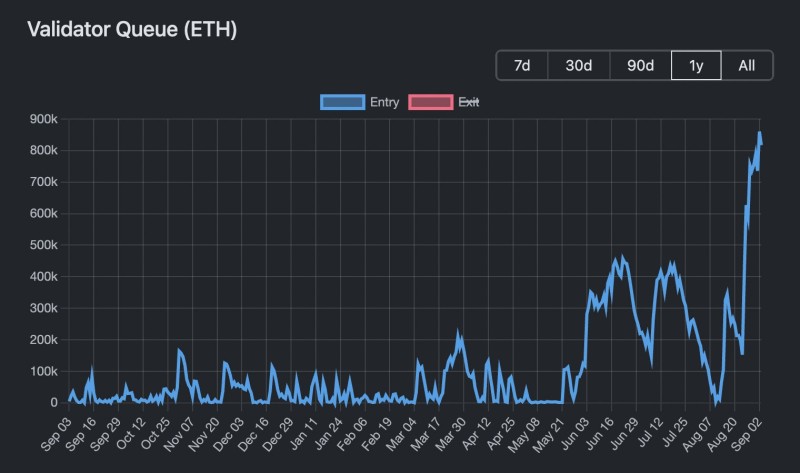

Trader @CryptoUncle0x recently pointed out a significant milestone as the validator entry queue has climbed above 860,000 ETH, worth approximately $3.7 billion at current prices. This represents the highest backlog in two years, demonstrating robust appetite for Ethereum staking despite current market conditions.

The rapid accumulation of pending validators signals deep confidence in Ethereum's future prospects. The queue's growth indicates that both retail and institutional players are committed to long-term participation in the network.

Supply Dynamics and Price Implications

When validators stake their ETH, they effectively remove tokens from active circulation, creating potential upward pressure on price. This supply squeeze mechanism has historically supported bullish price action, especially when combined with sustained network activity.

The shift toward proof-of-stake has transformed Ethereum into an income-generating asset, attracting yield-focused investors who might have previously overlooked crypto. This fundamental change in investor behavior suggests a more mature market dynamic is emerging.

Market Positioning for Future Growth

The massive validator queue reflects strategic positioning by market participants who expect Ethereum to maintain its dominant role in decentralized finance and smart contracts. With over $3.7 billion committed to staking, the network's security and decentralization continue to strengthen.

Historical patterns suggest that periods of intense staking activity often precede significant price movements. As the queue processes and more ETH becomes locked, the reduced supply could create favorable conditions for a sustained rally if broader market sentiment improves.

Peter Smith

Peter Smith

Peter Smith

Peter Smith