Institutional adoption of cryptocurrency continues to gain momentum, with traditional financial firms increasingly viewing digital assets as legitimate portfolio holdings. The latest development comes from Yunfeng Financial Group, whose substantial investment in Ethereum demonstrates the growing institutional appetite for ETH beyond its utility as a blockchain token.

Institutional Confidence in Ethereum

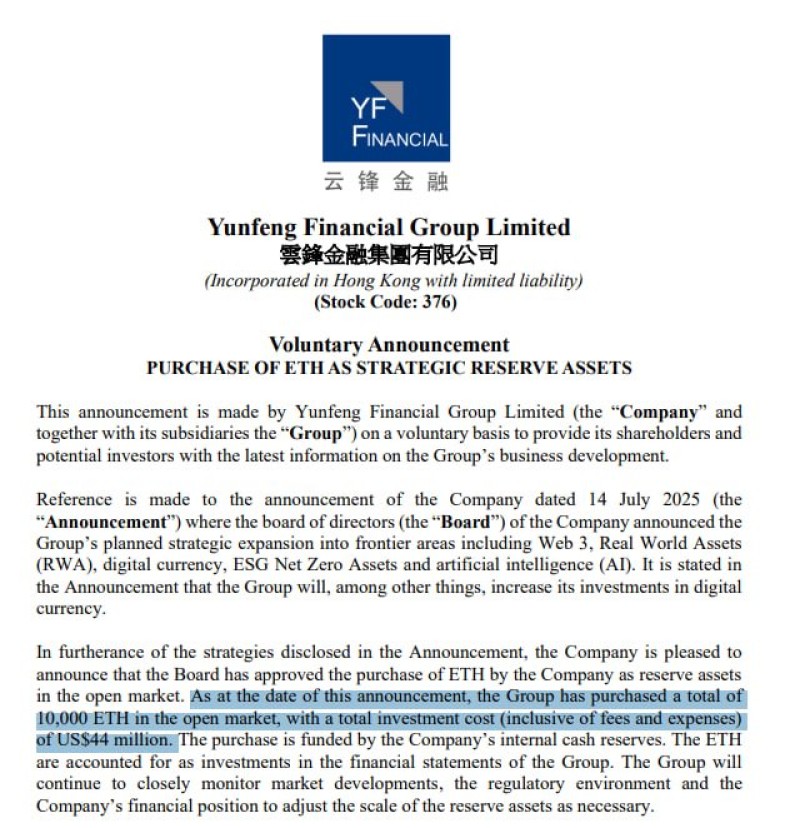

Market analyst highlighted Yunfeng Financial Group's decision to buy 10,000 ETH on the open market - a $44 million move that shows how major financial players now see ETH as more than just blockchain fuel. They're treating it as a serious store of value.

This purchase fits into Yunfeng's bigger picture as they expand into Web3, Real World Assets, digital currency, ESG investments, and AI. By adding ETH to their balance sheet, they're betting big on Ethereum's future in the digital economy.

Ethereum (ETH) Price Could Benefit From Strategic Buys

When the news broke, ETH was trading around $3,100, taking a breather after some recent ups and downs. Big institutional purchases like this one tend to create stronger price floors, making dramatic selloffs less likely while increasing the chances of testing higher levels like $3,400 and beyond.

History shows that Ethereum typically responds well to institutional adoption news. The fact that Yunfeng used their own cash reserves rather than borrowed money shows they're really committed to holding ETH long-term.

ETH Outlook: $44M Buy Adds Fuel to the Bullish Case

Ethereum has already proven itself as the go-to platform for DeFi, NFTs, and decentralized apps. Now with institutional players like Yunfeng jumping in, analysts think we might be seeing a shift where ETH gets recognized not just as a network token, but as a legitimate reserve asset that traditional finance can embrace.

If more companies follow Yunfeng's lead, we could see steady buying pressure that pushes ETH toward new highs for this cycle. The institutional money is starting to flow, and that could be exactly what Ethereum needs for its next major move up.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah