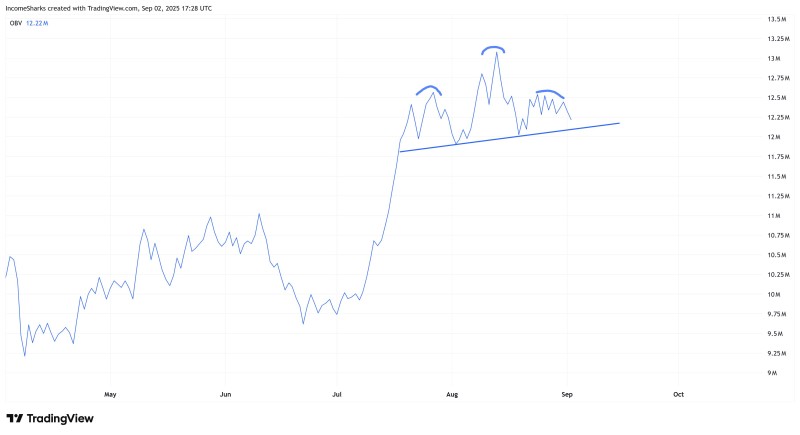

Ethereum finds itself at a crucial crossroads as technical indicators begin to flash warning signs. While the cryptocurrency has shown impressive strength in recent weeks, deeper analysis of volume patterns reveals potential weakness brewing beneath the surface. The emergence of a bearish Head and Shoulders formation in the On-Balance Volume could signal a shift in market sentiment that traders need to watch carefully.

Ethereum Bulls Confront a Critical Test

Despite ETH's recent strength, market signals are starting to show cracks. Trader @IncomeSharks has identified a Head and Shoulders pattern in the On-Balance Volume (OBV), which is a classic warning sign that buying momentum might be fading. With OBV sitting around 12.22M, this suggests that fewer people are buying into the recent price moves.

For bulls, this is basically a wake-up call - they need to step up quickly to break this pattern before it leads to bigger problems.

Ethereum is currently trading just under $3,500, hanging onto recent gains but having trouble pushing higher. If the bulls can get their act together and break this volume pattern, we could see ETH test the $3,800-$3,900 resistance area again.

But if selling pressure keeps building and the OBV confirms this bearish setup, ETH could easily drop back to $3,200 support or even lower.

What Traders Should Watch

The next few trading sessions are going to be make-or-break time. If this OBV breakdown plays out, we could be looking at a bigger correction ahead. But if the bulls can flip the script and take control of the volume flow, this whole Head and Shoulders thing might just turn into a fake-out that actually boosts confidence in ETH's long-term prospects.

Peter Smith

Peter Smith

Peter Smith

Peter Smith