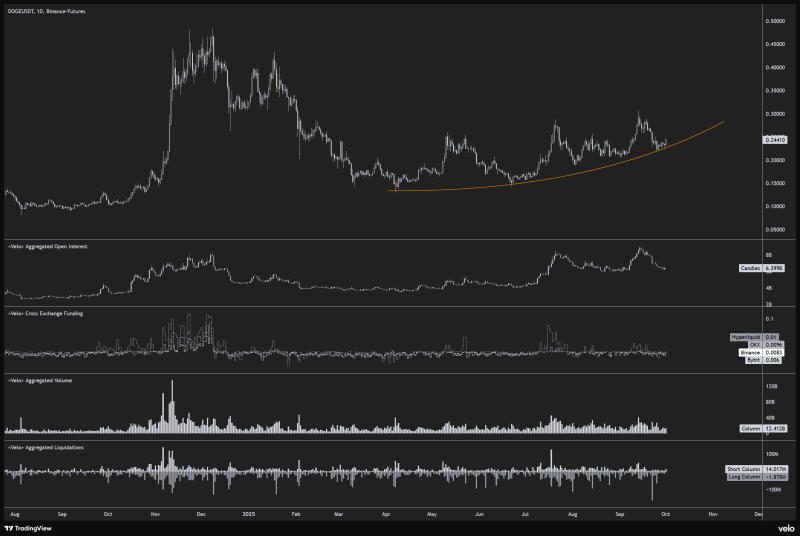

Dogecoin is doing something interesting. While the broader crypto market churns sideways, DOGE has been quietly building a foundation - making higher lows on the daily chart.

What the Chart Is Actually Saying

As Byzantine General pointed out, this classic accumulation pattern suggests buyers are stepping in stronger each time. It's the kind of setup that often precedes explosive moves, and traders are starting to take notice.

The chart tells a compelling story. That ascending orange support line isn't random - it's marking progressively higher floors, each one a sign that sellers are losing ground. Futures open interest is holding steady with slight upticks, meaning traders are positioned but not overleveraged. Funding rates remain neutral, which is actually good news since it means longs aren't overcrowded yet. Volume spikes keep appearing at local bottoms, confirming buyers are defending these levels aggressively. And unlike previous rallies that ended in liquidation cascades, this structure looks healthier and more sustainable.

Why This Setup Could Actually Work

So why could DOGE actually break out this time? The retail crowd never really left - they're just waiting for a spark. If Bitcoin continues climbing, liquidity tends to overflow into high-beta altcoins like Dogecoin. And let's be honest, social media hype is still DOGE's superpower. When momentum kicks in, this coin moves faster than logic suggests it should.

The levels that matter are straightforward. Break cleanly above $0.30 and suddenly $0.35 to $0.40 comes into play. But lose $0.20 to $0.22 support and this whole pattern falls apart. Right now, bulls are holding the line.

Peter Smith

Peter Smith

Peter Smith

Peter Smith