After weeks of sliding prices, Dogecoin is sitting at a crossroads. The meme coin has found support in a historically strong demand zone, but technical analysts aren't rushing in just yet.

The Technical Setup

TraderSZ summed it up perfectly in a recent tweet: "not going to try to pick a bottom but will wait for the reclaim then go for trigger." It's a patient approach that prioritizes confirmation over speculation—and the chart backs it up.

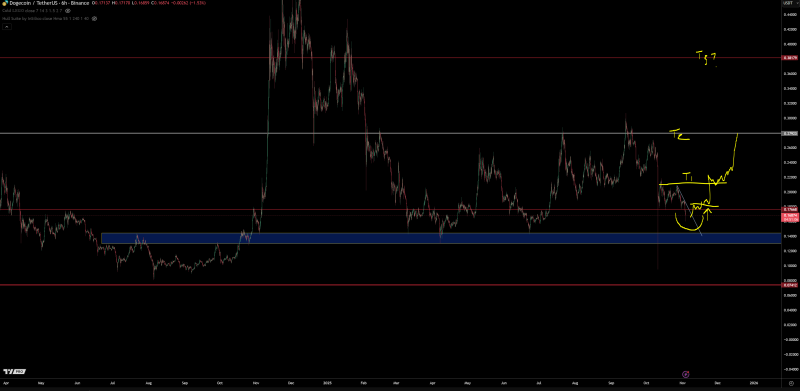

DOGE is currently trading around $0.17, resting above a blue demand zone between $0.14 and $0.15 that's been a launching pad for past rallies. The chart hints at a rounded bottom pattern—a classic accumulation signal—but the real test is whether it can reclaim the $0.19–$0.20 level. That's where the first trigger sits:

- T1: ~$0.19–$0.20 — the breakout level that would confirm renewed momentum

- T2: ~$0.27 — next resistance at a prior swing high

- T3: ~$0.38 — major target where previous rallies topped out

Until DOGE pushes convincingly through that first resistance with solid volume, this remains a "wait and see" situation. The yellow arc on the chart suggests a possible cup-like bottom, but without the breakout, it's just potential—not proof.

Why the Caution?

Trying to pick bottoms in volatile assets like Dogecoin is a quick way to get burned. By waiting for the reclaim above $0.19–$0.20, traders are betting on strength rather than hoping for a turnaround. If the breakout happens, momentum could accelerate fast toward $0.27 and even $0.38, especially if Bitcoin and Ethereum catch a bid and pull liquidity back into risk-on plays like meme coins.

For now, DOGE looks more like it's accumulating than capitulating—but the trigger hasn't been pulled yet. Traders are watching closely, ready to move when the chart gives them the green light.

Peter Smith

Peter Smith

Peter Smith

Peter Smith