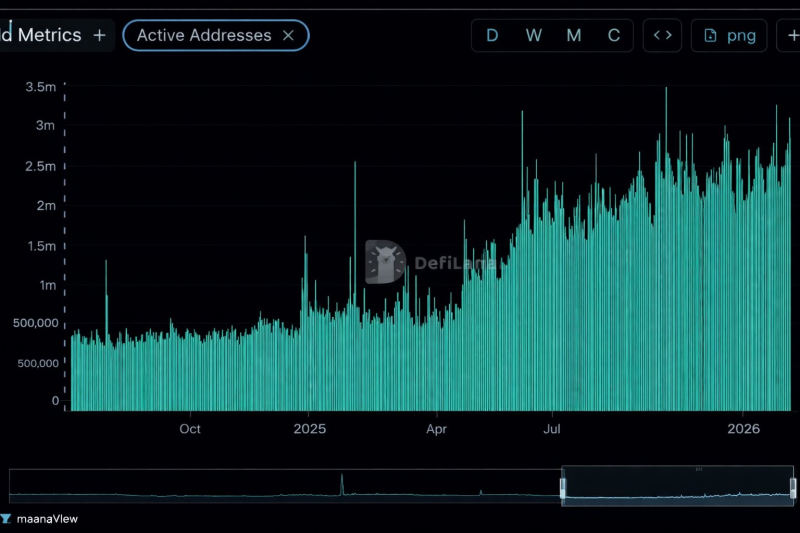

⬤ BNB Chain's network activity has been climbing steadily since May 2025, when daily active addresses sat around 1 million. By January 2026, that number more than tripled to over 3 million users. The growth chart shows a consistent upward trend through the second half of 2025 into early 2026—this wasn't just a quick pump and dump in user numbers, but real sustained engagement month after month.

⬤ What makes this growth pattern interesting is how stable it's been. Instead of seeing wild spikes that disappear overnight, the active address count has been forming a rising floor. Lower transaction fees brought people back to the chain, while DeFi protocols and gaming dApps kept them sticking around. This kind of steady baseline growth usually signals that users are actually using the platform, not just showing up for airdrops or short-term incentives.

"The combination of increased liquidity and a growing user base contributed to stronger overall network momentum."

⬤ Timing played a role too. Over $1 billion in stablecoin money flowed into BNB Chain in late 2025, right when user activity was ramping up. That liquidity boost helped support the growing number of active participants and pushed engagement to all-time highs. The chart reflects this alignment—when more capital and more users arrive together, network effects start compounding instead of fizzling out.

⬤ For the broader crypto market, this matters because it's reshaping the Layer-1 competition. BNB Chain's active address growth is now outpacing Ethereum's recent user expansion, which changes how developers think about where to deploy their projects. Sustained increases in real usage create stronger network effects—the kind that influence which chains developers choose and where users eventually congregate. As BNB Chain continues stacking consistent engagement numbers rather than chasing one-off spikes, it's proving that steady growth can shift competitive dynamics more effectively than short-term hype cycles.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah