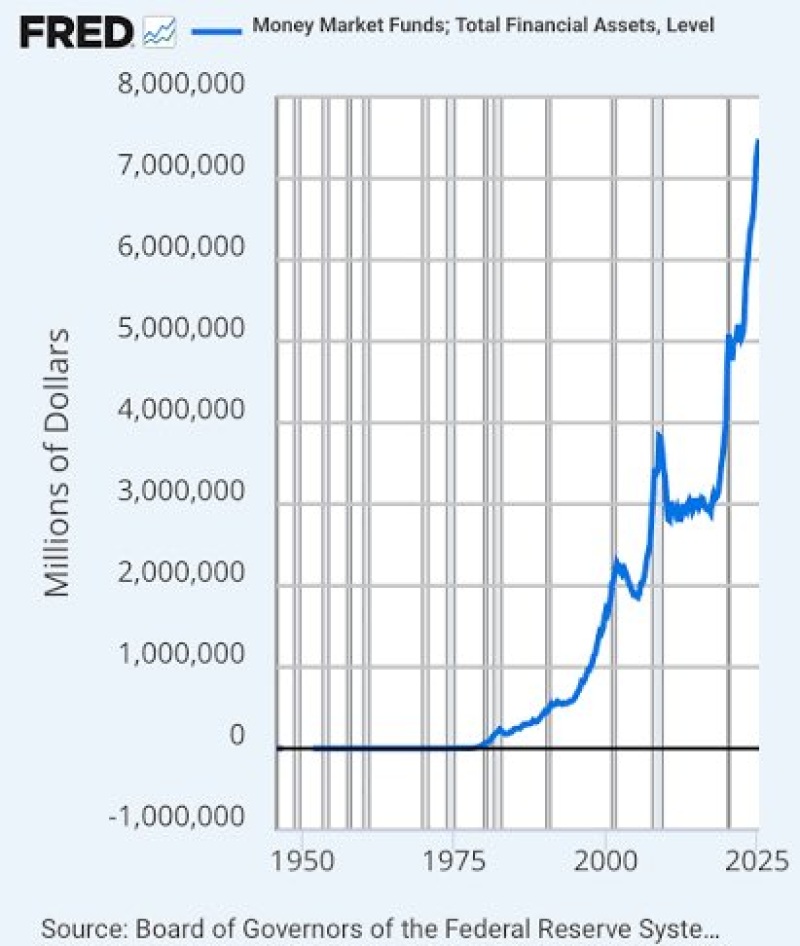

⬤ Federal Reserve data shows that U.S. money market fund assets have hit a record $7 trillion. The surge reflects years of investors parking cash in low-risk accounts during the Fed's rate-hiking cycle.

⬤ Market observers are watching this enormous capital reserve closely. The thinking is simple: when rates fall, money sitting in low-yield accounts tends to chase better returns. Crypto could be one destination for that capital.

⬤ The $7 trillion figure comes straight from official Fed data. Whether funds actually move into crypto markets remains speculation, but the logic follows a familiar pattern—falling rates typically push investors toward riskier assets.

⬤ The sheer amount of idle cash in the financial system matters. Even a small percentage shifting out of money funds could significantly impact crypto demand, especially for major assets like Bitcoin and XRP, as the rate environment changes.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi