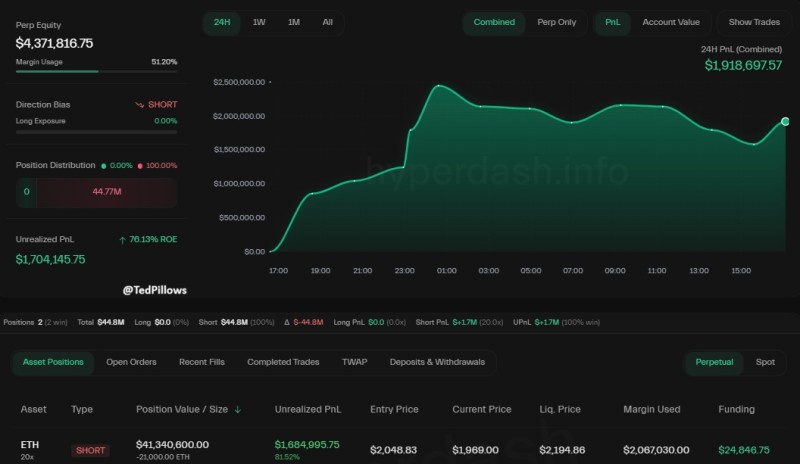

⬤ A high-stakes derivatives trade has emerged in the crypto market as a whale opened a $41.34 million short position on Ethereum with 20x leverage. According to Ted, this aggressive bet will face full liquidation if Ethereum's price increases by approximately 12%. The sheer size and leverage of this position immediately caught the attention of crypto traders monitoring whale activity.

⬤ The whale shorted 21,000 ETH at an entry price near $2,048.83 while Ethereum was trading around $1,969 at the time the position was captured. This bearish move has already generated an unrealized profit of roughly $1.68 million with an 81.52% return on equity, benefiting from Ethereum's recent price decline. However, the position sits on a knife's edge—the liquidation threshold of $2,194 leaves minimal room for error with such extreme leverage.

⬤ This trade signals a strong bearish conviction on Ethereum's near-term price action. Massive leveraged positions like this don't just reflect market sentiment—they can actively shape it. Liquidation zones from these whale bets often act as volatility magnets, creating self-fulfilling price movements as the market approaches critical levels. We've seen similar scenarios before, including instances where ETH whales bet $100M on price drops and broader Ethereum liquidation risk scenarios where leveraged positions amplified market swings dramatically.

⬤ Visible liquidation clusters like this $2,194 level can significantly influence short-term market dynamics. If Ethereum rallies toward the liquidation price, forced buying from automated position closures could trigger rapid upward price movement. Conversely, continued downside would keep the short profitable and potentially embolden other bears. Market analysts are closely watching this setup alongside technical indicators like Ethereum's demand zone recovery outlook to anticipate potential volatility spikes and positioning opportunities.

Usman Salis

Usman Salis

Usman Salis

Usman Salis