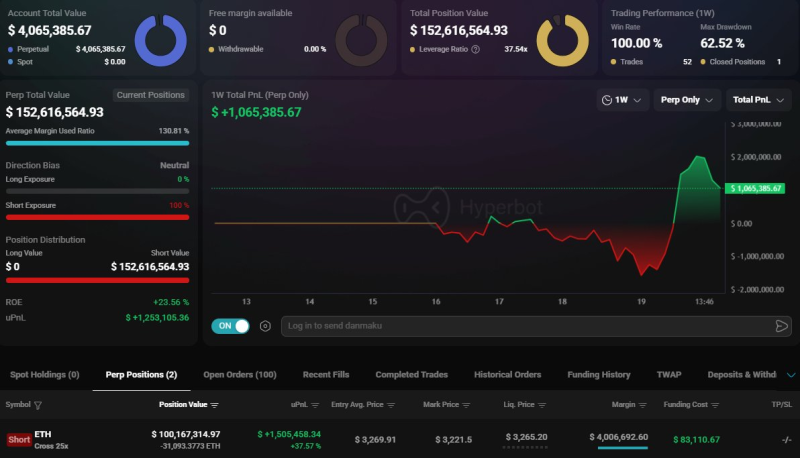

⬤ A heavyweight trader has made waves in Ethereum markets by opening a short position worth roughly $100 million using extreme 25x leverage. According to @MaxCrypto, this high-risk play has a liquidation trigger set near $3,265 — meaning if ETH climbs to that level, the entire position gets automatically closed out. The timing comes during a particularly volatile period across crypto markets, making this bet even more dramatic.

⬤ The trader's account snapshot shows they're all-in on the bearish side, with ETH exposure topping $100 million in total value. What makes this especially risky is how little room there is for the trade to go wrong — even a modest price jump toward $3,265 could wipe out the position. When the screenshot was captured, Ethereum was trading safely below that danger zone, letting the whale rack up some solid unrealized profits while staying in the game.

A move toward the $3,265 level would likely trigger heightened volatility, as liquidation-driven buying could amplify upward momentum.

⬤ Positions this size don't just sit quietly in the background — they can actually move markets, especially in derivatives trading where forced liquidations create chain reactions. If Ethereum rallies toward $3,265, we'd likely see sudden buying pressure as the system automatically closes the short, potentially pushing prices even higher. But if ETH keeps dropping, this whale's bet pays off big while adding more downward pressure on the price.

⬤ What really stands out here is how much leverage major players are willing to use right now. When whales deploy this kind of firepower, it affects more than just their own profit and loss — it shapes overall market mood, changes funding rates across exchanges, and can destabilize prices across related crypto assets. With Ethereum hovering near critical price levels, this $100 million leveraged position could be a major factor in determining where ETH heads next.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova