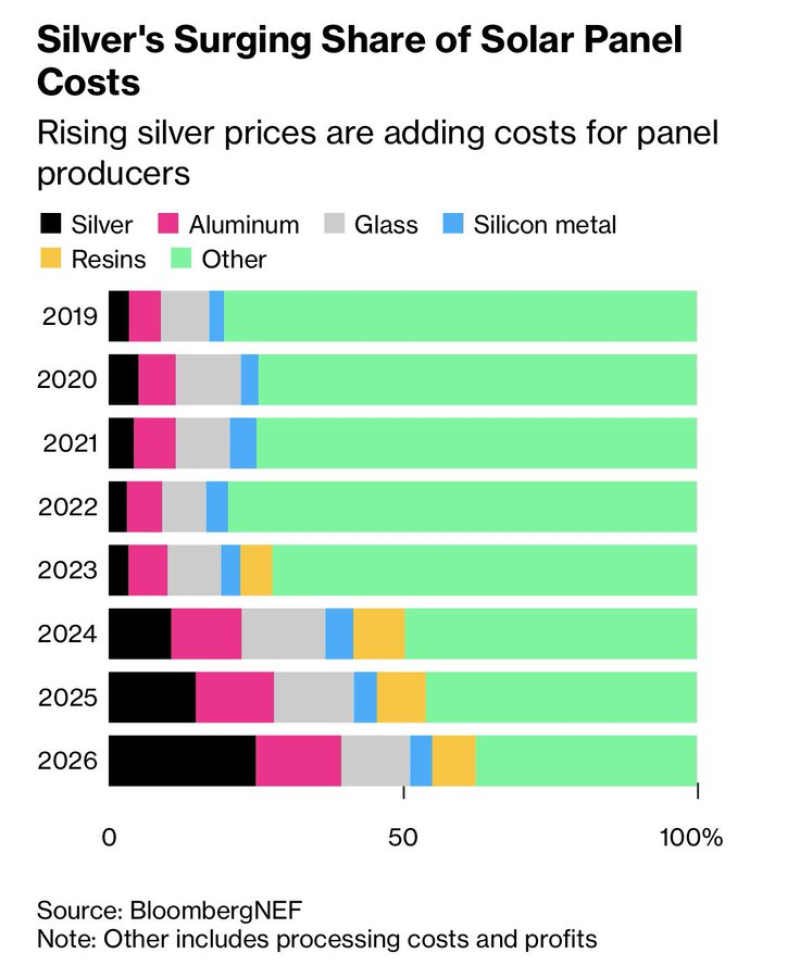

⬤ Silver is taking over as a major cost driver in solar panel manufacturing. The metal accounted for just 3% of total production costs in 2023 but is expected to hit 30% by 2026. BloombergNEF data confirms this dramatic shift, showing silver's cost share expanding faster than any other input.

⬤ The transformation is striking. Between 2019 and 2022, silver barely registered compared to processing costs, aluminum, and glass. Starting in 2023, silver's share began climbing rapidly, overtaking traditional components one by one. By 2026, it becomes one of the largest single material costs in the entire production chain—a reflection of both rising prices and silver's essential role in photovoltaic cell conductivity.

⬤ Other materials like aluminum, glass, silicon, and resins are still important, but their cost shares have grown slowly and steadily. Silver's increase stands out because it's sharp and concentrated in just a few years. The data shows this surge comes from actual price increases, not from savings elsewhere in manufacturing.

⬤ This matters because solar manufacturing is extremely sensitive to input costs. China produces 70% of the world's solar panels and refines 60% of global silver supplies, so any volatility in silver prices or availability now directly impacts renewable energy economics. As silver becomes a dominant cost factor, it could reshape solar deployment costs, squeeze manufacturing margins, and create new supply chain vulnerabilities in the global energy transition.

Peter Smith

Peter Smith

Peter Smith

Peter Smith