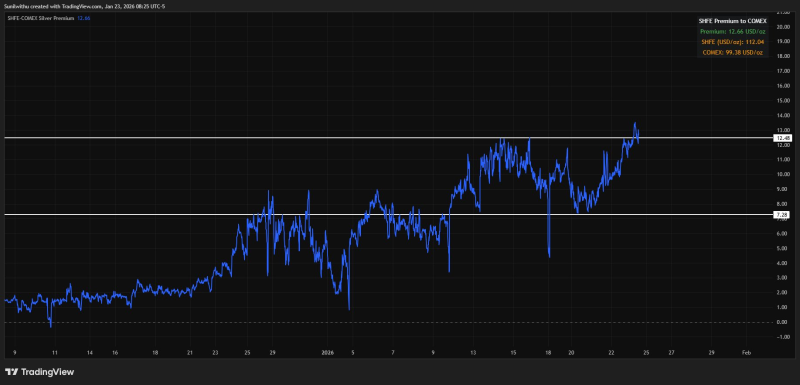

⬤ Here's the thing: silver markets just recorded a massive divergence that's got traders talking. The SHFE–COMEX spread climbed into the $13 per ounce territory, completely blowing past the old $8 to $12 range that had been holding things in check. Asian silver prices are now running way ahead of Western benchmarks, and the charts don't lie—this premium's hitting record levels.

⬤ The numbers tell the story pretty clearly. SHFE silver was trading north of $110 per ounce while COMEX silver sat around $99, creating one of the widest gaps we've ever seen. That's a premium you can't ignore, and it's pointing to serious demand pressure coming out of China compared to what we're seeing in global markets.

The spread climbed into the $13 per ounce area, surpassing the prior range that had capped between roughly $8 and $12.

⬤ Breaking through that old $8–$12 band isn't just noise—it's a structural shift. Previous rallies would hit that ceiling and stall out, but this time the spread kept pushing higher. The steady climb suggests there's real underlying pressure here, not just a quick volatility spike that'll fade away.

⬤ Why does this matter? Because we're watching global silver pricing fragment in real-time. When you've got a record SHFE–COMEX spread like this, it affects everything—physical flows, arbitrage plays, inventory decisions across exchanges. Traders are now watching closely to see if this divergence holds or keeps widening, because it's definitely shaping what happens next in precious metals markets.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah