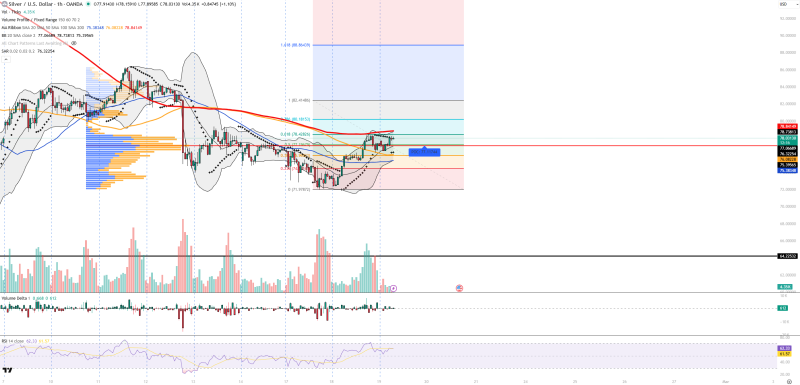

⬤ Silver has recovered on the hourly chart after finding support at 75.30 and pushing toward the 78.00 area. The move looks like a short-term bounce for now, with the main downtrend not yet fully broken.

⬤ Price is now approaching the 78.40-78.80 resistance band, a zone traders have been watching closely. There is a short-term balance area near 77.11 where activity has been concentrated. This setup is similar to when silver pushed into a breakout rally toward the 79 area.

⬤ Momentum is supportive: RSI sits around 62, which is positive without being overbought. Bollinger Bands show price pushing toward the upper band, Parabolic SAR is still flashing bullish, and volume picked up during the rebound. The current bounce from 75.30 echoes a previous setup when silver tested the 75-76 support zone during a key decision phase.

⬤ Order flow data shows buyers holding a slight edge. Key support levels to watch are 77.03, 76.32, 75.40, and 73.97. On the upside, resistance sits at 78.47, 78.73, 80.18, and 82.41. The risk of a pullback remains real, as seen when silver dropped toward the 74.80 support area as bearish structure held.

⬤ The broader outlook ties silver closely to the US dollar and overall risk sentiment. If DXY stays soft, a test of the 80 region becomes realistic. However, stronger-than-expected US data could push price back below 77 and leave the trend question unanswered for longer.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah