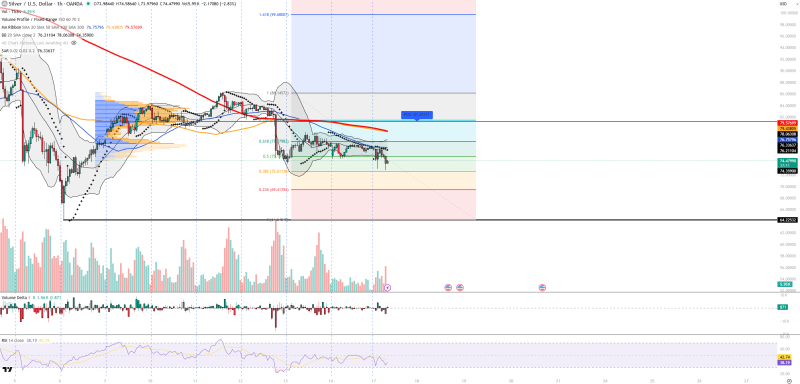

⬤ Silver is grinding lower on the hourly chart, stuck beneath its major moving averages with no convincing recovery in sight. Price is heading toward the 74.80 level — a critical short-term support that the market is now actively testing. The pattern of lower highs keeps stacking up, which tells us that any bounces we've seen recently are just corrections, not real signs of a trend reversal.

⬤ The technical picture for Silver isn't doing buyers any favors right now. RSI is sitting around 38 — weak momentum, but not yet in oversold territory, meaning there's still room to fall before any mechanical bounce kicks in. Selling volume has been picking up on the down moves, the volume delta shows sellers in control, and price is hovering near the lower Bollinger Band. The Parabolic SAR is also pointing bearish. Meanwhile, the volume profile puts the point of control up at 81.25, making that zone the dominant overhead resistance to watch.

⬤ Here's how the key levels stack up: supports are at 74.80, 74.35, 72.61, and 69.41, while resistances sit at 76.33, 76.75, 79.43, and 81.25. Every rally attempt has faded before breaking anything meaningful on the upside. A similar dynamic played out when price held above the 74.40 support area, and again when the 75–76 support zone was tested.

⬤ Beyond the chart, macro headwinds are adding to the pressure. A stronger U.S. dollar continues to weigh on silver, and soft global growth expectations aren't helping industrial demand. Risk-off flows could offer brief stabilization, but the broader structure stays bearish as long as price remains capped below the 81.40 resistance level. A clean break below 74.80 would open the door toward 72.61 and potentially 69.41.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah