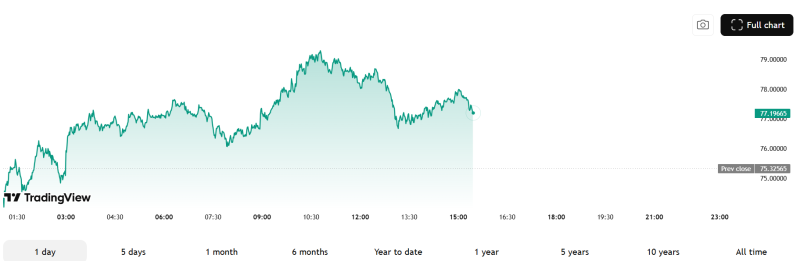

The precious metals market is heating up, and silver is leading the charge. Spot prices jumped to $79.15 per ounce in a dramatic rally that's caught the attention of traders and investors worldwide. This breakout comes after months of consolidation and signals a major shift in market dynamics as both industrial demand and macro positioning converge.

Silver Prices Break Through $79 Resistance Level

Spot silver has pushed sharply higher, hitting $79.15 per ounce during the latest surge. The move marks a significant breakout from the prolonged consolidation pattern that kept prices rangebound for weeks. Chart analysis confirms that expanding bullish momentum is driving the rally, with price action clearing previous resistance zones and maintaining strong upward continuation.

The breakout isn't happening in isolation. It's part of a broader strengthening across the entire metals complex, where precious metals are showing coordinated gains. This type of synchronized movement typically signals more than just short-term speculation—it reflects genuine shifts in market fundamentals and investor positioning.

What's Driving the Silver Rally?

Silver occupies a unique position in commodity markets, serving double duty as both a monetary metal and a critical industrial input. This rally appears to be fueled by both sides of that equation. The magnitude of the price surge suggests strengthening demand dynamics across multiple sectors, particularly in energy transition technologies and industrial manufacturing.

"The current breakout reflects expanding participation rather than just short covering," noted market analysts tracking the move. "When silver sustains gains like this instead of immediately retracing, it signals real demand underneath the rally."

Previous consolidation periods in silver have often preceded major expansion moves. The current structure mirrors earlier volatility compression patterns that came just before directional breakouts. A comparable setup appeared when silver was consolidating after a strong rally, where price held corrective support before continuing higher.

Silver vs Gold: Shifting Precious Metals Dynamics

The silver breakout is also changing the relative performance picture between precious metals. Similar structural conditions emerged when silver was nearing critical resistance against gold, highlighting how trend expansion phases can shift the balance between these two metals.

This matters because silver tends to react simultaneously to monetary expectations and industrial demand cycles. When both drivers fire at once—as they appear to be now—the rallies tend to be more sustainable. The sustained expansion across precious metals could indicate rising hedging activity, tightening supply conditions, or accelerating real-economy demand, making silver a key indicator for broader cross-market sentiment shifts.

Usman Salis

Usman Salis

Usman Salis

Usman Salis