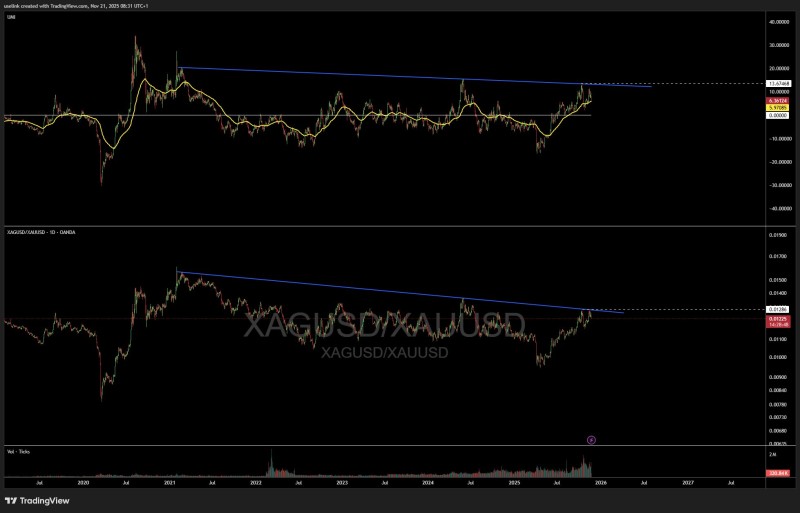

⬤ Silver's performance against gold is reaching a critical juncture as XAG approaches the 1.3% threshold in their price ratio. This level has historically separated consolidation periods from stronger upward trends. Recent charts show long-term resistance lining up with declining trendlines, creating mounting pressure for a decisive breakout.

⬤ The spread between XAG and XAU has been tightening for years, with previous attempts to break above this zone failing to hold. A move past 1.3% in silver's relative pricing would represent a meaningful change in market dynamics. Momentum indicators are supporting this setup as price action pushes steadily toward multi-year trendline resistance. This alignment points to silver potentially challenging levels not seen since before extended downturns in the metals space.

⬤ Breaking above this zone would carry implications beyond silver itself. Such a move could mark the start of silver outperforming gold, a cycle that happens infrequently but tends to be significant when it occurs. Mining stocks typically respond aggressively during these phases, as they're leveraged to silver's moves relative to gold. The momentum buildup visible across both metals reinforces this possibility.

⬤ The silver-to-gold spread often reflects broader shifts in precious metals sentiment, risk appetite, and macro confidence. A breakout in XAG against XAU could signal growing demand for higher-volatility hard assets, a pattern that usually accompanies reflationary or cyclical expansion phases. If momentum holds and silver clears this longstanding threshold, it may mark the beginning of a notable shift in precious metals dynamics heading into 2026.

Alex Dudov

Alex Dudov

Alex Dudov

Alex Dudov