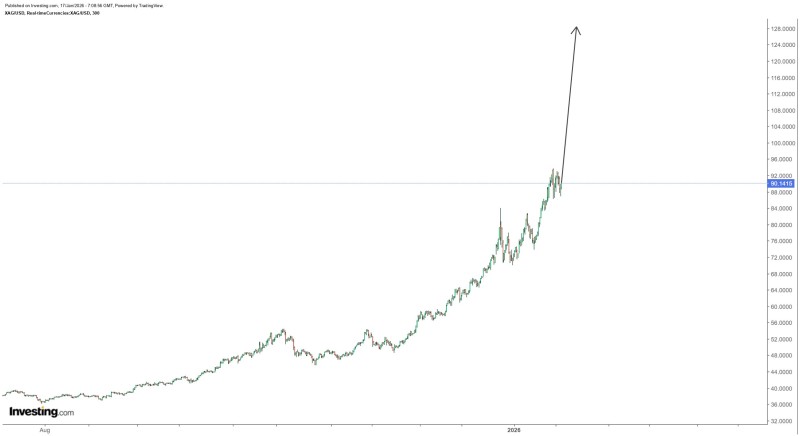

⬤ Silver has been on a tear, accelerating its climb after years of steady gains. The metal is now trading near the $90 mark, up dramatically from much lower levels. What's notable is how the rally has shifted gears—what started as a methodical climb has turned into a faster-paced advance, signaling that buyers are getting more aggressive.

⬤ The technical picture tells a clear story: consistent higher highs and higher lows, with momentum picking up noticeably in recent months. After spending time consolidating earlier in the trend, silver's price trajectory has steepened considerably. Recent trading sessions show minimal retracements, which means sellers haven't been able to slow down the advance. With no major resistance levels visible on the chart, the path forward appears open for continued gains.

⬤ Silver isn't moving in isolation. Gold has also been climbing steadily during this same period, and the relationship between the two metals—often measured by the gold-to-silver ratio—can amplify moves when trends intensify. The current environment appears momentum-driven rather than range-bound, suggesting silver is being powered by sustained demand rather than technical bounces.

⬤ Extended rallies in precious metals usually don't happen in a vacuum. They often reflect deeper shifts in economic conditions, currency strength, and investor positioning. When silver makes big moves like this, it tends to ripple through related markets—commodity sectors, mining stocks, and even currency pairs. As silver continues pushing higher within its established uptrend, traders are watching closely for what this might signal about broader market sentiment and risk appetite heading into 2026.

Usman Salis

Usman Salis

Usman Salis

Usman Salis