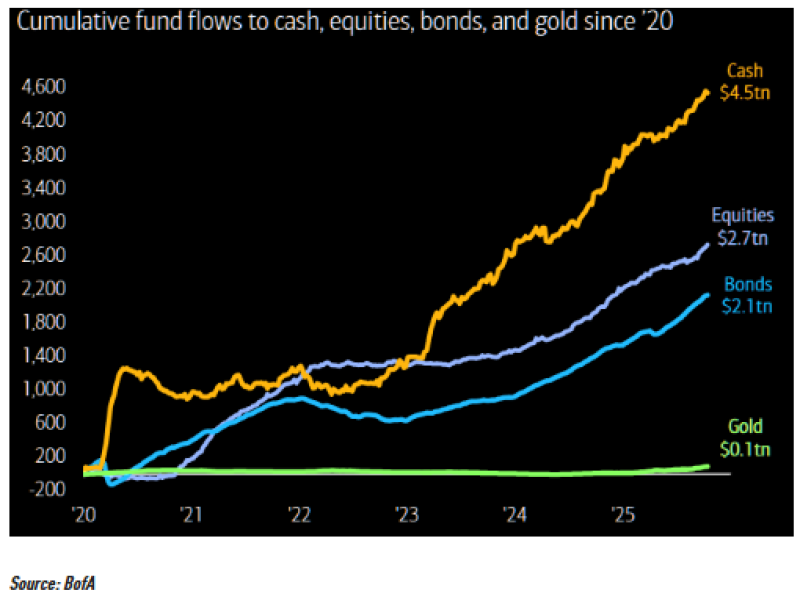

● Here's a head-scratcher for you: while gold has been on a tear, hardly anyone's been buying it. According to fresh data from Bank of America shared by Barchart, gold saw only $100 billion flow in since 2020. Meanwhile, investors dumped a mind-boggling $4.5 trillion into cash, $2.7 trillion into stocks, and $2.1 trillion into bonds.

● Think about that for a second. Gold prices have rallied hard, driven by inflation fears and global uncertainty, yet most investors opted to sit in cash instead of hedging with the yellow metal. It's a classic case of missing the forest for the trees.

● What's driving this behavior? Simple: people wanted safety and liquidity. Between interest rate chaos, banking scares, and economic volatility, parking money in cash felt like the smart move. But here's the catch — all that sidelined capital is earning modest returns while gold owners have been laughing all the way to the bank. The gold rally picked up serious steam through 2023 and 2024, fueled by weak currencies and central banks buying gold like there's no tomorrow.

● From an allocation standpoint, the numbers tell an interesting story. Money market funds have been hoovering up trillions thanks to decent yields, but gold's been largely ignored. That light positioning could actually be bullish — if sentiment shifts and money starts rotating into hard assets, gold could have plenty of room to run. Some strategists are already suggesting it's time to move some cash into gold, especially with real yields likely heading lower and inflation possibly making a comeback in 2025.

Usman Salis

Usman Salis

Usman Salis

Usman Salis