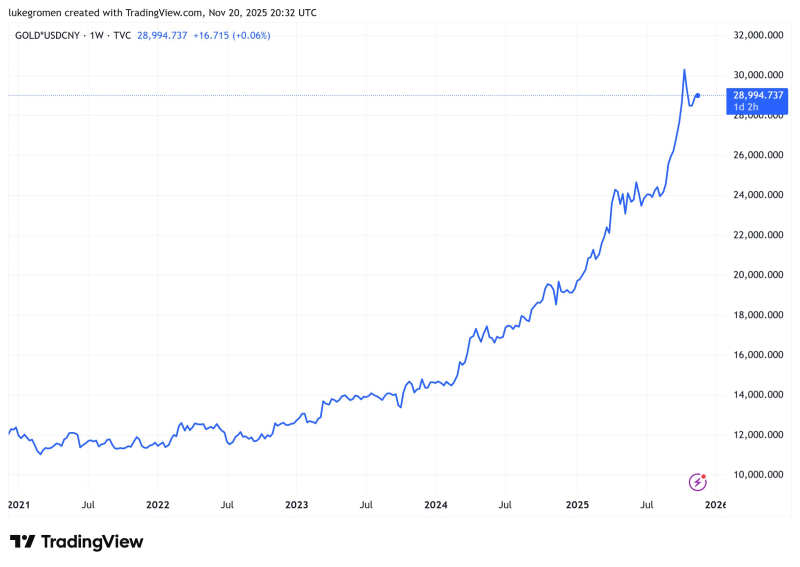

⬤ China's gold market has been on fire, with the GOLD×CNY chart showing a massive multi-year climb that's got everyone talking. Word on the street, as @LukeGromen pointed out, is that Chinese officials might be pushing gold as the go-to option for building long-term wealth, while making it clear that homes should just be places to live—not investment vehicles. This is a totally different vibe from what's happening in the U.S., where we're now seeing 50-year mortgage loans pop up.

⬤ The numbers tell the story pretty clearly. Gold priced in yuan has rocketed from around 11,000 yuan back in early 2021 all the way up to roughly 29,000 yuan by late 2025. That's one of the strongest runs we've seen in years. The momentum really kicked into high gear throughout 2024 and 2025, with gold breaking into fresh territory before taking a breather and leveling off. This steady climb backs up what people are saying—that gold's becoming a bigger deal as a way to store wealth inside China compared to real estate.

The persistent upward movement reflects the strengthening demand profile, reinforcing the idea that gold may be taking on a larger role as a domestic store of value compared with real estate.

⬤ What makes this shift interesting is the bigger picture. Moving people away from property-driven wealth building to precious-metal savings could actually help with social stability. The timing lines up too—gold's steep rise is happening right as China's property sector deals with some serious uncertainty. The chart's long-term slope shows that gold's got real staying power in China's financial system, crushing most other domestic options.

⬤ This matters because when a whole country changes how it thinks about building wealth, it affects everything—where money flows, how families save, and overall market vibes. If China really does lean into gold while treating housing more practically, it could totally reshape long-term saving habits and take pressure off property markets. With gold in yuan pushing toward record levels, we're watching policy direction and stability concerns drive serious demand for hard assets.

Peter Smith

Peter Smith

Peter Smith

Peter Smith