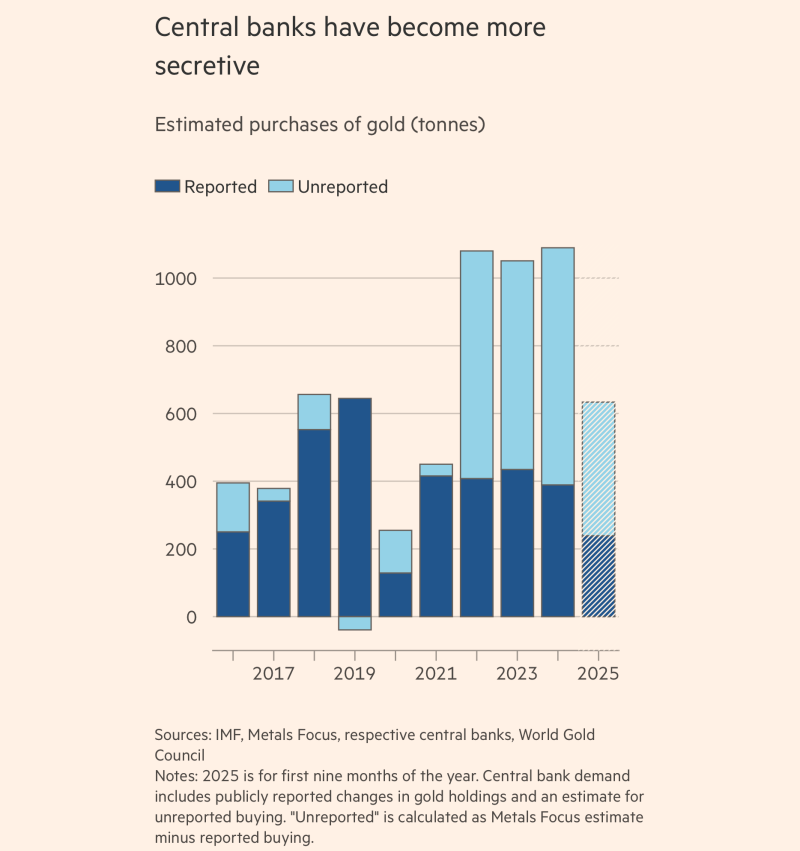

⬤ Central banks around the world are buying way more gold than official records show. According to recent analysis, roughly two-thirds of all central bank gold purchases never make it into public reports. Charts tracking the last few years paint a clear picture: while reported buying stays relatively modest, unreported purchases have been climbing steadily, revealing a major shift toward secrecy in how nations build their gold reserves.

⬤ The numbers tell an interesting story. Data from the IMF, Metals Focus, individual central banks, and the World Gold Council shows that officially reported gold purchases typically fall between 300 and 450 tonnes per year. But here's the kicker: unreported buying exploded in 2022 and 2023, pushing total estimated demand past 1,000 tonnes. In recent years, hidden acquisitions have actually exceeded what central banks publicly disclosed. Even the partial 2025 data covering just nine months shows substantial unreported activity continuing.

⬤ This growing gap between what's reported and what's actually happening represents a real change in how central banks handle their gold reserves. Since 2017, the share of hidden buying has jumped noticeably, with several years showing massive spikes in unreported activity while official disclosures stayed relatively flat. The pattern suggests many central banks are choosing to keep their gold transactions under wraps rather than broadcasting them to the world.

⬤ The widening split between public and private gold buying matters for traders and investors. Gold remains a go-to reserve asset when geopolitical tensions rise, currencies get shaky, or monetary systems shift. When central banks stockpile gold in secret, it creates uncertainty around actual supply and demand, which can definitely impact prices down the road. As this secretive buying trend continues, the gold market might become less transparent, affecting how traders read market signals and set their expectations.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi