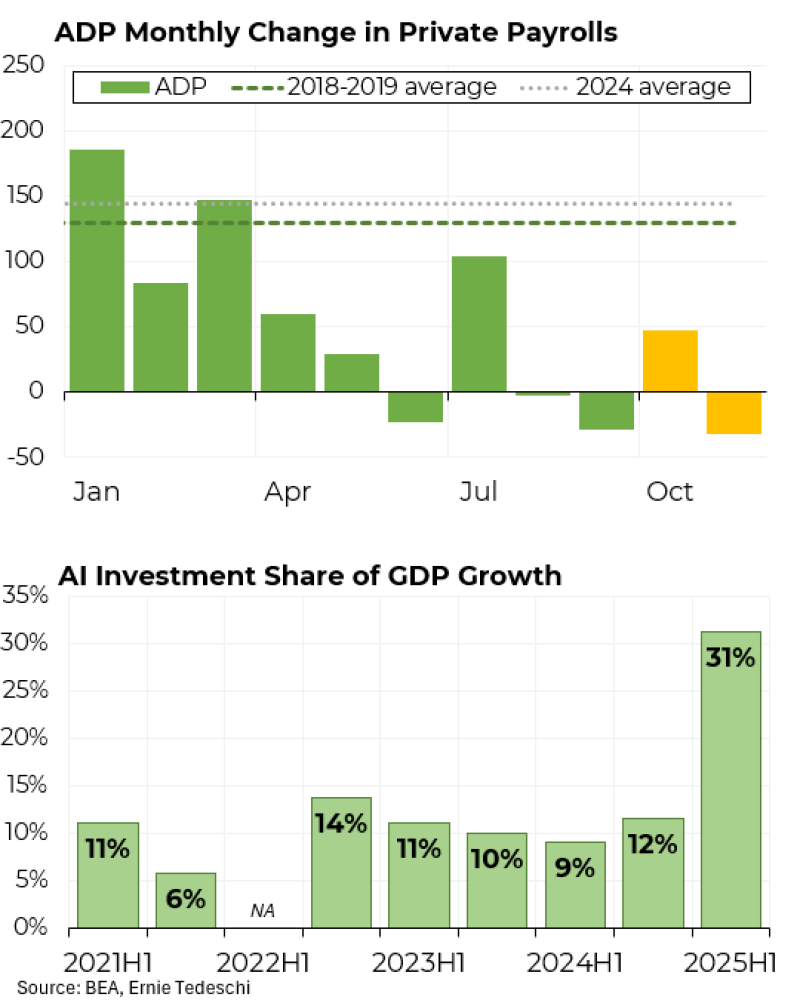

⬤ The US economy is showing a strange split right now. Recent data points to a widening gap between strong GDP numbers and a struggling job market. ADP's private payroll figures have been all over the map this year—starting strong in early 2024, then steadily cooling off through spring and summer. By fall, we were actually seeing monthly job losses of 30,000 to 40,000 positions. Meanwhile, AI investment is propping up headline growth figures in a big way, but it's not creating nearly as many jobs as you'd expect from that level of economic activity.

⬤ The job market tells a concerning story. Private sector hiring kicked off the year above 150,000 new positions monthly, but those gains didn't last. As we moved through spring, hiring momentum kept fading. The numbers fell well below the 140,000 monthly average we saw back in 2018-2019, and they're tracking under the 2024 average too. What's worrying here is that companies are pulling back on hiring even though the economy still looks solid on paper—it raises real questions about whether this job market weakness is here to stay.

⬤ Here's where things get really interesting: AI investment is absolutely exploding as a share of GDP growth. From 2021 through 2024, it bounced around between 6% and 14% of total growth. But projections for the first half of 2025 show it jumping to 31%—that's a massive leap. Companies are pouring money into AI infrastructure and technology at an unprecedented rate. The problem? This spending inflates GDP figures without creating proportional employment gains. It's a textbook case of productivity-driven growth that looks great in economic reports but doesn't put people to work.

⬤ This disconnect between GDP performance and job creation creates a tricky situation for markets and policymakers. We might be heading into a period where the economy keeps growing on paper thanks to AI-driven productivity, but employment stays weak. That makes it harder to judge whether the economy is actually healthy or just being propped up by capital spending in one sector. As AI cements its role as the dominant force in business investment, its lopsided impact on output versus jobs could reshape everything from market expectations to how we think about economic strength going forward.

Victoria Bazir

Victoria Bazir

Victoria Bazir

Victoria Bazir