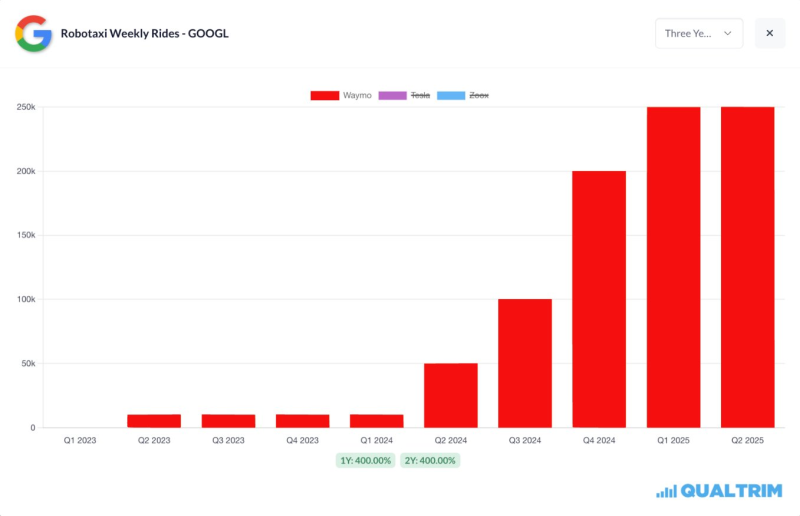

⬤ Google has pulled decisively ahead in autonomous driving, with Waymo officially passing 100 million public self-driving miles as of July 2025. Weekly Waymo rides have exploded from barely 10,000 in early 2023 to over 250,000 by late 2024, staying near those peaks into 2025. This massive commercial rollout has put GOOGL stock and Waymo's technology at the center of the autonomous driving conversation.

⬤ Google has pulled decisively ahead in autonomous driving, with Waymo officially passing 100 million public self-driving miles as of July 2025. Weekly Waymo rides have exploded from barely 10,000 in early 2023 to over 250,000 by late 2024, staying near those peaks into 2025. This massive commercial rollout has put GOOGL stock and Waymo's technology at the center of the autonomous driving conversation.

⬤ The industry faces regulatory headwinds and tax policy uncertainty that could reshape robotaxi economics. Potential corporate tax increases, R&D deduction limits, or capital-gains changes might drive up costs for AI transportation companies. Smaller players without Google's deep pockets could struggle if compliance costs rise or funding dries up, while higher taxes on stock-based pay might push engineering talent overseas. Even Google could face slower fleet expansion or delayed infrastructure builds under heavier tax burdens.

⬤ The gap is striking: Waymo announced 100 million-plus public self-driving miles as of July 2025, while Tesla has logged just 50,000 internal testing miles. This contrast highlights the enormous difference between Google's fully operational robotaxi network and Tesla's limited internal program.

⬤ With weekly rides jumping from under 10,000 to over 250,000 in less than two years, Google has locked in its lead in commercial autonomous mobility. Though tax policy shifts could affect future economics, Waymo's operational scale, real-world data edge, and growing consumer adoption cement its position as the robotaxi market leader. As the race to full autonomy accelerates, GOOGL remains central to the future of self-driving technology.

⬤ The industry faces regulatory headwinds and tax policy uncertainty that could reshape robotaxi economics. Potential corporate tax increases, R&D deduction limits, or capital-gains changes might drive up costs for AI transportation companies. Smaller players without Google's deep pockets could struggle if compliance costs rise or funding dries up, while higher taxes on stock-based pay might push engineering talent overseas. Even Google could face slower fleet expansion or delayed infrastructure builds under heavier tax burdens.

⬤ The gap is striking: Waymo announced 100 million-plus public self-driving miles as of July 2025, while Tesla has logged just 50,000 internal testing miles. This contrast highlights the enormous difference between Google's fully operational robotaxi network and Tesla's limited internal program.

⬤ With weekly rides jumping from under 10,000 to over 250,000 in less than two years, Google has locked in its lead in commercial autonomous mobility. Though tax policy shifts could affect future economics, Waymo's operational scale, real-world data edge, and growing consumer adoption cement its position as the robotaxi market leader. As the race to full autonomy accelerates, GOOGL remains central to the future of self-driving technology.

Usman Salis

Usman Salis

Usman Salis

Usman Salis