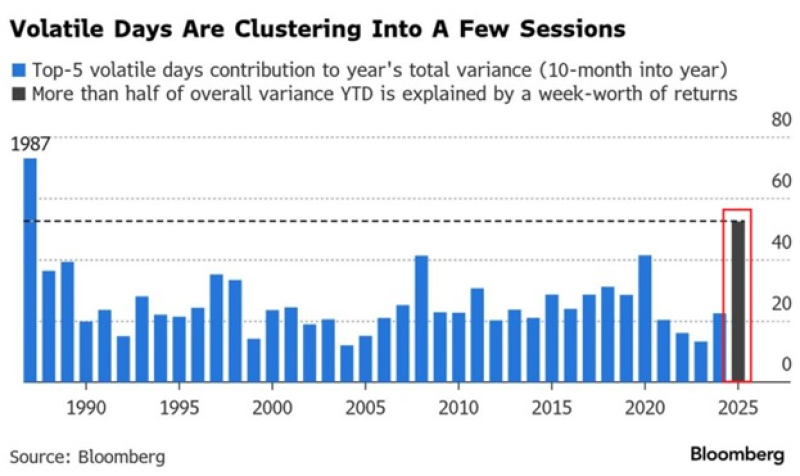

● The US stock market is experiencing something remarkable and unsettling: five trading sessions alone have driven nearly 50% of the year's total market volatility. That's double what we saw in 2024 and five times higher than 2023.

● Think about that for a moment — half the year's chaos packed into just a handful of days. It shows how jumpy investors have become, reacting dramatically to every piece of news or economic data.

● Since 2000, we've only seen this kind of concentration twice before: in 2008 during the financial crisis and in 2020 during the pandemic lockdowns. Both times, the world was falling apart. But here's the twist — 2025 doesn't have a full-blown systemic meltdown. Even minor announcements are now triggering massive market moves.

Half of all volatility this year came from just five trading sessions — the highest concentration since 1987. The market has become hypersensitive. As The Kobeissi Letter put it

● This clustering of volatility isn't just a curiosity — it's a warning sign. When action gets compressed into so few days, it's usually driven by algorithmic trading, thin liquidity, and investors on high alert. Markets start behaving erratically. Price discovery breaks down. The risk of sudden, sharp corrections goes up.

Peter Smith

Peter Smith

Peter Smith

Peter Smith