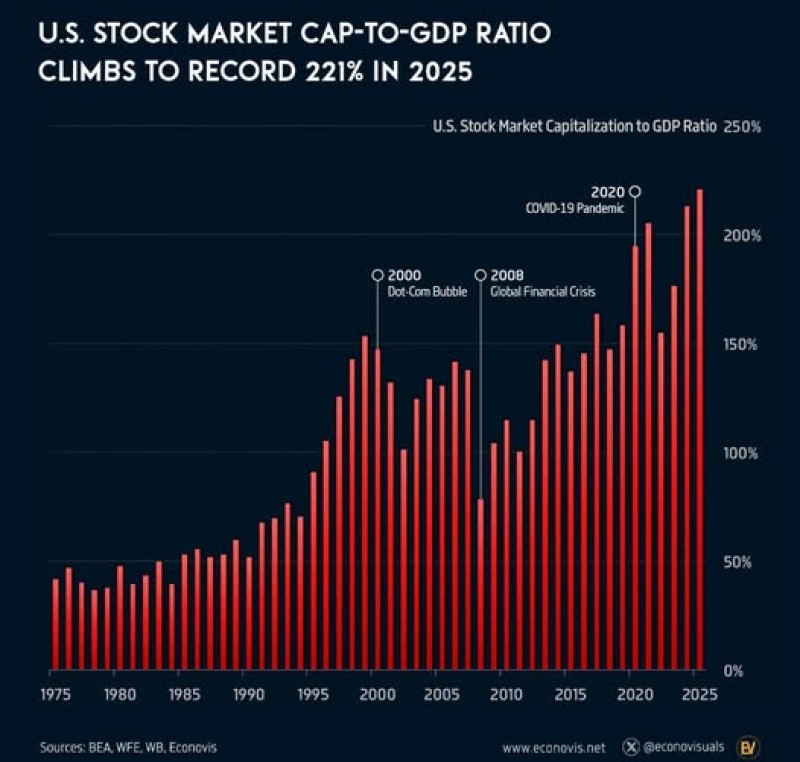

The U.S. stock market has entered unprecedented territory in 2025. The market capitalization-to-GDP ratio - often called the "Buffett Indicator" - now stands at 221%, eclipsing the peaks of both the Dot-Com Bubble and the COVID-19 surge. This metric compares the total value of publicly traded companies to the size of the economy, and today's reading signals extreme investor enthusiasm relative to economic fundamentals.

A Historic Disconnect From Past Market Peaks

According to trader and market analyst The Kobeissi Letter, the current 221% ratio dwarfs every major market peak in recent decades. During the 2000 Dot-Com Bubble, the ratio topped out at 142% before collapsing.

By the 2008 Global Financial Crisis, it had fallen to historic lows - today's reading is 4.6 times higher. Even the COVID-19 pandemic spike in 2020 pales in comparison. Since April alone, the ratio has jumped 58 percentage points, and it has remained above its long-term average of roughly 87% for 13 consecutive years.

What's Driving Valuations to Extremes

Several powerful forces are pushing the ratio to record highs. Tech dominance plays a major role - mega-cap companies like Apple, Microsoft, NVIDIA, and Amazon now represent a massive share of total market value, far outpacing their contribution to GDP. Years of accommodative monetary policy have fueled investor confidence, while global capital continues to flow into U.S. stocks as a perceived safe haven. The result is a widening gap between Wall Street valuations and Main Street economic activity.

What This Means for Investors

The Buffett Indicator isn't a precise timing tool - markets can stay elevated for extended periods. But history shows that extreme readings like today's have typically preceded weaker returns or corrections. Investors face a dual reality: opportunities still exist in technology and innovation-driven sectors, but risks are mounting as high valuations leave little room for error. Navigating this environment requires staying selective, maintaining diversification, and being prepared for increased volatility.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah