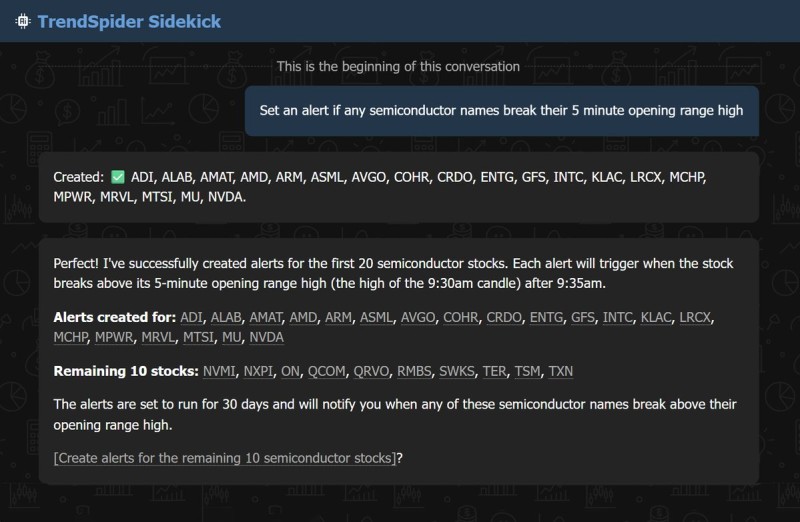

⬤ Taiwan Semiconductor Manufacturing Company ($TSM) just dropped earnings that crushed expectations, sending ripples of excitement through the entire semiconductor space. The strong numbers immediately caught the market's attention, with $TSM's performance lighting a fire under the whole industry. Trading platforms activated alerts on key semiconductor players like $NVDA, $AMAT, and $AMD, putting them on breakout watch to catch any significant moves.

⬤ What makes $TSM's earnings report so important is that it sets the tone for the entire chip sector. Semiconductors have been red-hot lately thanks to booming demand from AI development, data centers, and the never-ending need for more chip production. This surge is showing up in price action across the board, with automated trading tools ensuring traders don't miss a beat when these stocks start moving.

⬤ The real game-changer here is how automation is transforming market monitoring. Instead of manually watching dozens of tickers, traders can rely on tools that instantly flag important price movements. This kind of technology is reshaping how quickly the market can react to breaking news and earnings surprises.

⬤ The semiconductor sector is flexing its muscles right now, and $TSM's stellar performance proves the bullish momentum is real. With AI and automation playing bigger roles in both the products these companies make and how traders track them, we're likely seeing just the beginning of what could be an extended run for chip stocks.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi