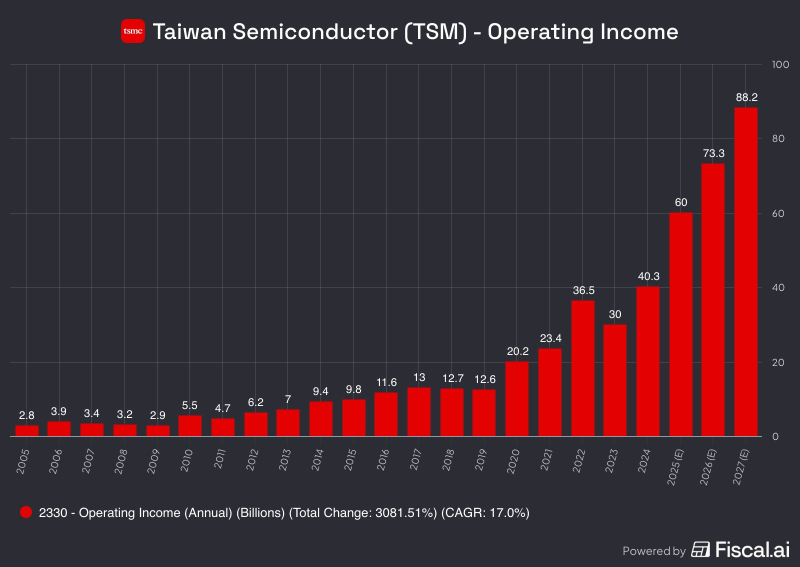

⬤ Taiwan Semiconductor Manufacturing Company (TSM) is catching serious attention as long-term projections show massive operating income expansion ahead. Charts tracking performance from 2005 through 2027 reveal steady profit growth with a sharp acceleration in recent years. Analysts are now eyeing approximately $88 billion in operating income by 2027—a figure that would mark the company's highest profitability level on record.

⬤ The numbers tell a compelling story. Operating income climbed from around $3 billion in 2005 to over $40 billion by 2024. After a brief pullback in 2023, profitability bounced back hard, with estimates jumping to roughly $60 billion in 2025 and $73 billion in 2026. That projected $88 billion for 2027 reflects strong confidence in advanced semiconductor manufacturing demand continuing to surge.

⬤ The long-term perspective makes the growth even more impressive: total operating income has increased more than 3,000% since 2005, delivering a compound annual growth rate around 17%. This sustained expansion provides crucial context for TSM's current enterprise value hovering near $1.3 trillion. The alignment between decades of performance and forward-looking estimates shows just how much expectation is baked into today's valuation.

⬤ For the broader market, TSM's trajectory matters because the company sits at the center of global chip production and serves as a bellwether for the entire semiconductor industry. These rising profit projections reinforce the strength of demand for cutting-edge manufacturing capacity. The scale of these earnings expectations also reveals how tightly market sentiment is tied to long-term growth assumptions—making TSM's profit path a critical indicator for tracking the health and direction of the global chip sector.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi