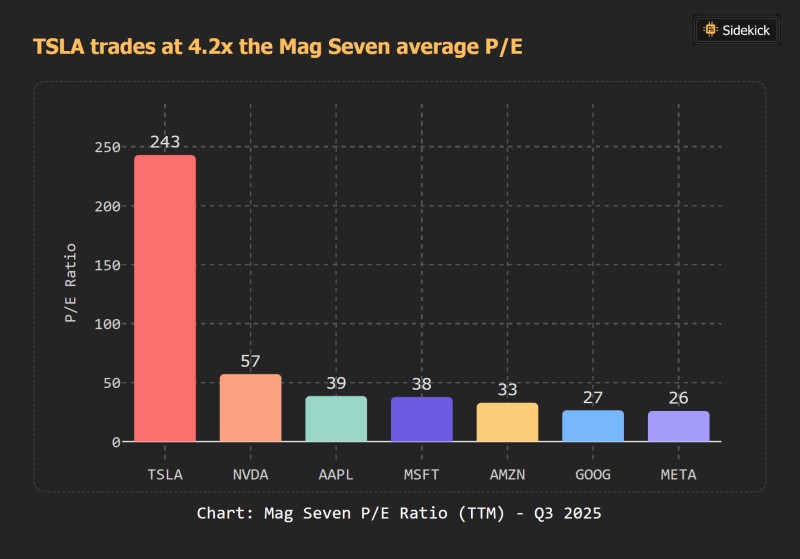

⬤ Tesla grabbed attention after fresh comparison data showed the company trading at a P/E ratio of 243—dramatically outpacing every other Mag Seven member. The gap isn't subtle: TSLA's valuation stands roughly 4.2 times above the group average, creating a massive divide between Tesla and the rest of big tech. No other company in the elite group comes anywhere close to matching this premium.

⬤ The numbers tell a striking story. Nvidia trades at a P/E of 57, Apple sits at 39, Microsoft at 38, and Amazon at 33. Alphabet comes in at 27, while Meta holds a 26 multiple. These six stocks cluster within a relatively tight range, while Tesla floats far above them all. The data makes it clear: the market is betting on Tesla's growth potential in ways that simply don't apply to other tech giants, even those posting strong earnings and holding dominant market positions.

⬤ This valuation gap stands out even more given the current environment. Several Mag Seven companies continue reporting solid earnings and maintaining competitive strength across their core businesses. Yet Tesla's premium persists, raising questions about the growth assumptions baked into its stock price compared to giants like Nvidia, Microsoft, and Amazon—all of which trade at substantially lower multiples despite their own expansion trajectories.

⬤ The valuation disparity matters beyond Tesla alone. It influences how investors view high-growth equities and where capital moves within large-cap tech. Such extreme differences can signal diverging market expectations or concentrated speculation around a single name. Tesla's position within the Mag Seven will likely remain a focal point in ongoing debates about tech sector pricing and whether TSLA's premium reflects justified optimism or unsustainable hype.

Usman Salis

Usman Salis

Usman Salis

Usman Salis