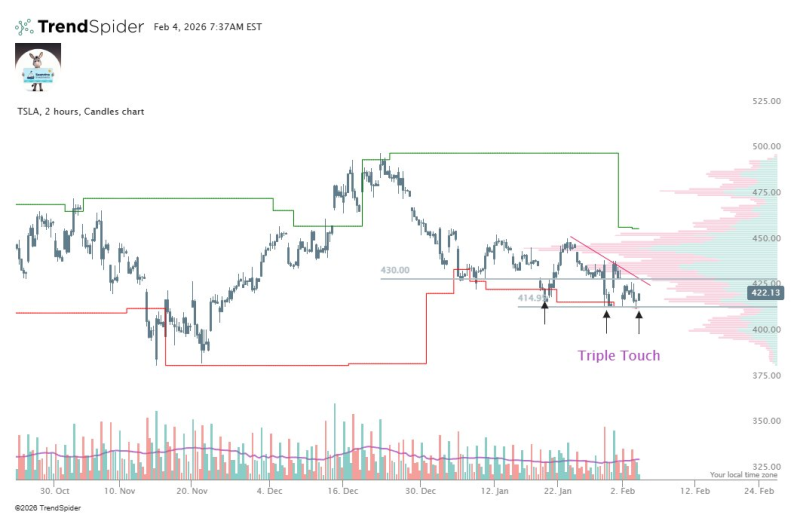

⬤ Tesla shares are trading at a technically significant level after forming a clear triple touch at support on the two-hour chart. Price action shows TSLA repeatedly holding the same downside area in the low $420s, with three separate tests failing to push the stock lower. Pre-market activity is showing early strength, with TSLA trading near $422 and up around 0.84 percent ahead of the regular session.

⬤ The chart illustrates how each pullback into this support zone was met with buying interest, creating a visible base. Recent price action has been capped by a declining trendline, keeping TSLA in a narrowing range. This compression reflects a balance between buyers defending support and sellers maintaining pressure from above.

⬤ Market structure emphasizes the importance of the current level. The volume profile shows a dense area of prior trading activity just above current prices, indicating this zone previously acted as equilibrium. The repeated defense of support, combined with improving pre-market price action, highlights growing sensitivity around this level.

⬤ Repeated tests of the same support often precede a larger move. Holding above this base would signal continued demand, while failure to maintain support would shift focus toward lower price zones. With Tesla at a clear technical inflection point, near-term behavior around $420s will likely influence short-term sentiment and volatility expectations.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova