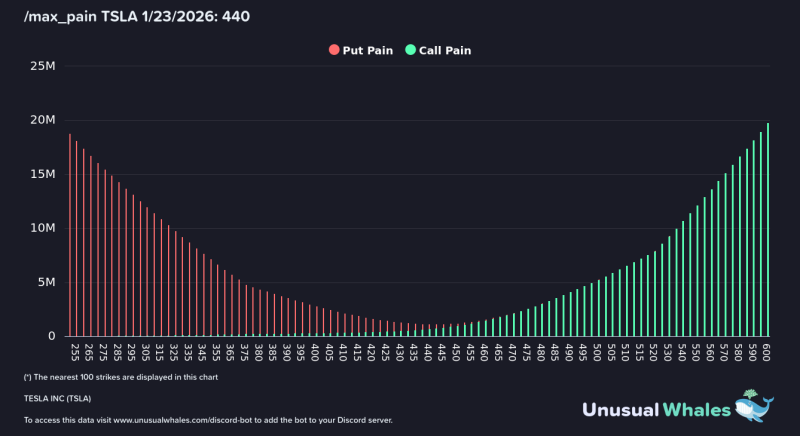

⬤ Tesla is heading into its January 23 options expiration with some pretty telling signs in the derivatives market. The stock's currently hovering around $430, just below the $440 max pain level—that sweet spot where the most options expire worthless. What's particularly interesting is how lopsided the positioning looks between puts and calls across different strike prices.

⬤ The put side tells a defensive story. There's a massive wall of put options stacked from the low $200s all the way through the $400s, with the heaviest concentrations sitting far below where the stock trades today. This isn't bearish positioning expecting an imminent crash—it's more like institutional insurance against a worst-case scenario. Since these puts are so far out of the money, they're unlikely to influence day-to-day price action.

⬤ The call side is where things get really interesting. Starting around $445, call exposure shoots up dramatically and keeps building through the $500s toward $600. The chart shows this almost vertical climb in open interest at higher strikes. If Tesla starts climbing, dealers who sold these calls will need to buy shares to hedge their positions, which could add fuel to any upward move and create a feedback loop of momentum.

⬤ This setup matters because it shows how options can actually move the underlying stock around expiration dates. Tesla's sitting below that $440 max pain level with a huge stack of calls overhead, making the stock sensitive to any momentum shifts. Those elevated call strikes could support a sharp move higher, but they might also become profit-taking zones if the price actually reaches them—it's a classic example of how derivatives shape real-time trading conditions.

Usman Salis

Usman Salis

Usman Salis

Usman Salis