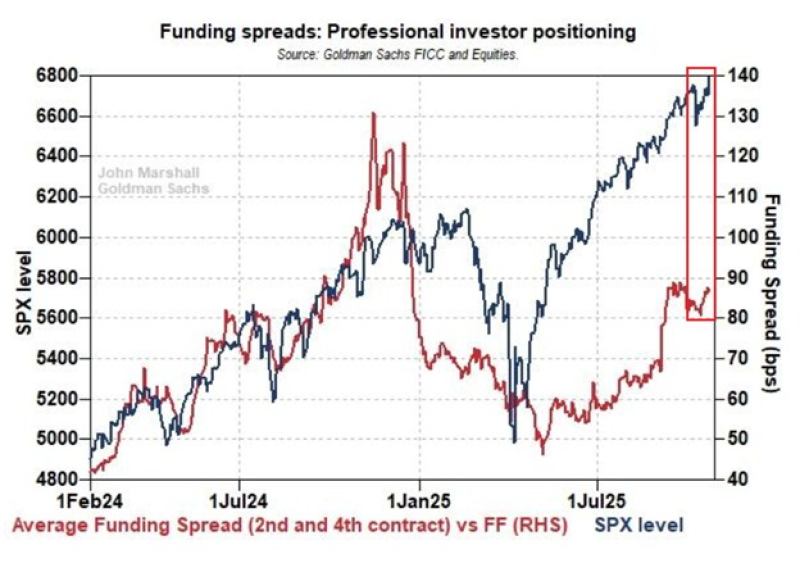

⬤ Goldman Sachs recently flagged a major jump in institutional stock positioning. Funding spreads shot up 8 basis points in just one week, hitting levels not seen since December 2024. These spreads track what investors pay to get leveraged exposure through futures, options, and swaps. When spreads spike like this, it means pros are willing to pay steep financing costs to stay in the game—a clear sign they're betting on more upside as the S&P 500 pushes new highs.

⬤ The buildup has been going on all year. Spreads have jumped 40 basis points since May 2025, showing just how aggressively institutions have been loading up. This pattern looks a lot like what happened during the 2024 rally, when rising spreads signaled strong bullish conviction. The chart shows the S&P 500 and funding spreads moving up together, confirming the tight link between institutional leverage and market strength.

⬤ The risk is that this kind of setup can get fragile fast. High spreads mean more investors are relying on borrowed money, which works great on the way up but can backfire if things turn. A sudden shift in spreads or tighter liquidity could force leveraged players to unwind positions, creating selling pressure. History shows that extreme funding levels often line up with periods when markets get more sensitive to swings.

⬤ For now, though, the momentum is strong. The Kobeissi Letter points out that institutions are clearly committed, willing to eat higher costs to stay exposed to equities. Combined with the S&P 500's continued strength, this wave of positioning shows that institutional appetite remains a major driver of the current rally—similar to what we've seen during past record runs.

Usman Salis

Usman Salis

Usman Salis

Usman Salis