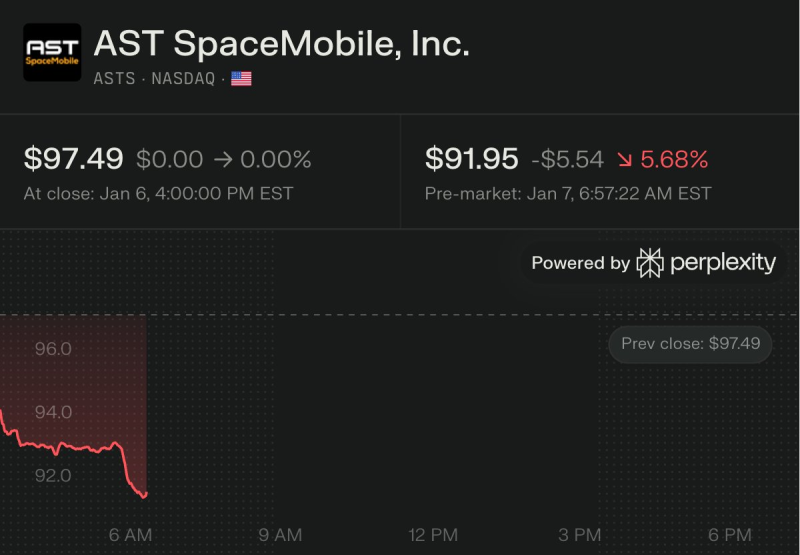

⬤ AST SpaceMobile (ASTS) found itself in the spotlight after Scotiabank slashed its rating to Sector Underperform and set a $45.60 price target. The analyst pulled no punches, saying ASTS shares had climbed to "irrational levels"—the stock was trading around $97.60 with a market cap pushing $37 billion. Here's the kicker: the company hasn't signed up a single retail customer yet. They still need to launch about 50 satellites to deliver continuous service in select markets, and that won't happen until late 2026 or early 2027 at the earliest. The stock closed at $97.49 on January 6 but dropped 5.68% in premarket trading to $91.95.

⬤ The analyst's concerns run deep. They're expecting sluggish user adoption in the U.S. and Japan, limited revenue per user, and massive capital spending ahead—including duplicate satellites for new frequencies. Meaningful cash flow might not materialize until 2028 or 2029. Then there's the competition problem. Starlink is expanding at breakneck speed with a globally recognized brand and fixed service growth that's accelerating fast. Starlink's current revenue already matches what roughly 340 million direct-to-consumer users would generate, potentially doubling to 680 million by the time ASTS launches in select markets. The numbers tell the story: while ASTS has launched seven satellites since 2017, Starlink put over 3,000 into orbit in 2025 alone.

⬤ Despite the harsh downgrade, Scotiabank made clear they don't view ASTS as a meme stock. They acknowledged the technology is genuinely disruptive with potential dual-use applications. But they also pushed back against analysts who dismiss ASTS's multi-year delays and Starlink's massive head start. The middle-ground scenario? A valuation between $45 and $55 per share. The bank reiterated its Sell rating.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova