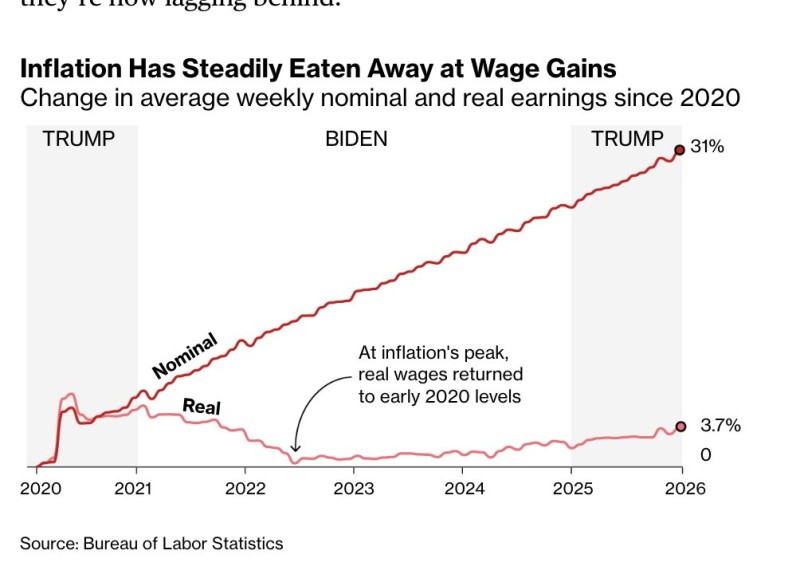

⬤ Inflation is slowing, but that doesn't mean prices are coming down. According to U.S. Bureau of Labor Statistics data, nominal wages rose around 31% since 2020, yet real wages gained only about 3.7%, briefly touching early-2020 levels during the worst of the inflation surge. As MoneyRadar noted, the numbers look better on paper than they feel in practice.

⬤ The pain is concentrated in exactly the things people can't avoid spending on. Since 2020, beef prices are up roughly 50%, coffee 59%, eggs 128%, rents 36%, electricity 56%, auto insurance 56%, auto repairs 63%, and childcare 39%. Mortgage payments have roughly doubled compared to pre-2020 conditions. A young couple today needs around 70% of annual income just for a down payment, compared to about 45% back in 2000. Prices didn't just spike; they reset at a new, higher level.

While inflation rates slow, the overall price level has not reversed.

⬤ The same pattern is playing out across other developed economies. Food prices in much of Europe and beyond rose 20 to 30% since 2021, and energy costs remain well above pre-crisis levels. Minimum wage increases of around 13% couldn't keep up with food inflation running near 20%. Debt cases among people aged 18 to 25 jumped roughly 65% in a single year, a sign that a lot of people are quietly running out of cushion.

⬤ The real story here isn't about inflation rates, it's about what prices permanently moved to. This isn't a temporary spike that corrects itself; it looks more like a structural reset of the cost of living. For more on how official CPI figures compare to what consumers actually experience, read Inflation Reality Check: CPI Shows Prices Keep Climbing.

Peter Smith

Peter Smith

Peter Smith

Peter Smith