Robinhood just delivered one of its best quarters ever, but there's a catch. The company is heavily dependent on the most unpredictable parts of retail trading. With 45% of revenue now coming from crypto and options, HOOD is riding a wave of speculative trading that can disappear when market sentiment shifts.

Robinhood's Record Quarter Comes With a Catch

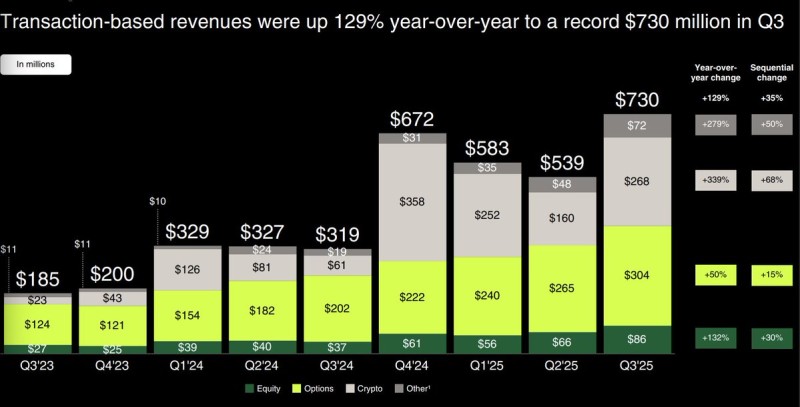

The Q3 results were undeniably strong. Transaction-based revenues jumped from $185 million in Q3'23 to $730 million in Q3'25—a massive 129% year-over-year increase and 35% quarter-over-quarter growth. But most of that growth came from the riskiest categories.

Crypto revenue exploded to $268 million, up a staggering 339% year-over-year. Options hit $304 million with a 50% YoY jump. Together, they account for nearly half of HOOD's entire quarterly revenue. Crypto surged 68% from the previous quarter, while options climbed 15%, both reflecting the risk-on mood dominating 2025's recovery. Equity trading reached $86 million—solid growth but nowhere near the explosive gains in speculative categories.

Robinhood now has 11 products each generating over $100 million annually, which shows progress on diversification. But the revenue mix still skews heavily toward high-volatility segments, explaining why Wall Street expects only 18% revenue growth next year despite recent momentum.

Why This Revenue Mix Matters

Here's what drives HOOD's current business model:

- Retail traders flock to speculative products when markets are hot, driving up crypto and options volumes dramatically

- Crypto's recent comeback cycle turbocharged revenue, particularly visible in Q2-Q3'25

- Options remain HOOD's most reliable high-margin engine, scaling fast when volatility picks up

- New products like retirement accounts and credit offerings show management's awareness of this problem, but they haven't yet shifted the revenue balance significantly

What This Means for Investors

In bull markets, HOOD is positioned beautifully. If risk appetite stays elevated, the company could easily beat consensus estimates. The operating leverage in crypto and options trading is significant when volumes are high.

In down cycles, the vulnerability becomes obvious. A market cooldown could hammer growth rates since so much revenue depends on speculative activity. When crypto goes quiet or volatility drops, HOOD's numbers take a hit.

On diversification, there's real progress. Non-trading products are gaining ground, which should help smooth out cyclicality over time. But right now, it's not enough to offset HOOD's structural exposure to market cycles.

The Takeaway

Robinhood's Q3 proves the company can crush it when conditions align. With 45% of revenue tied to crypto and options, HOOD thrives in lively markets but becomes unpredictable during quiet stretches. If retail enthusiasm holds, the company could outperform the modest 18% growth analysts expect. But if speculative trading cools off, that heavy reliance on volatile products will cap the upside. It's about weighing that risk-reward profile against your market outlook.

Usman Salis

Usman Salis

Usman Salis

Usman Salis