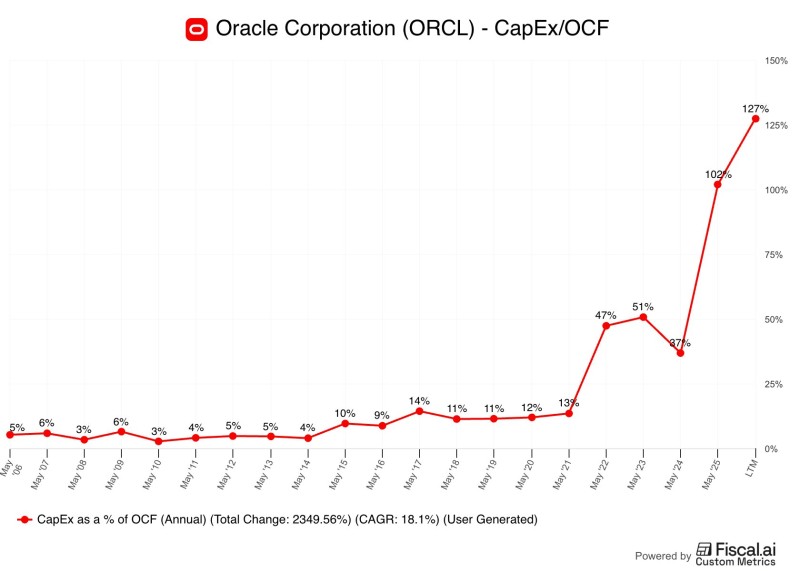

Oracle Corporation (ORCL) is undergoing one of the most dramatic financial transformations in its history. The enterprise software pioneer, once known for its capital-light business model, has pivoted hard into infrastructure spending. Today, Oracle is investing 127% of its operating cash flow into capital expenditures, forcing investors to reconsider what kind of company Oracle is becoming.

Oracle's CapEx Explosion

This isn't just expansion. It's a fundamental reimagining driven by artificial intelligence and Oracle's determination to compete with cloud hyperscalers. The question is whether this aggressive bet will pay off or become a cautionary tale.

The numbers are striking. As highlighted by Fiscal.ai (formerly FinChat), Oracle maintained consistent capital spending for nearly fifteen years. Between 2006 and 2020, CapEx hovered around 10–12% of operating cash flow, aligned with its identity as a software company.

Then came the shift:

- 2022: 47% of OCF

- 2023: 51% of OCF

- 2025: 127% of OCF

Oracle is now spending more on infrastructure than it generates from operations, crossing a threshold that separates software companies from infrastructure-heavy cloud providers.

Why Is This Happening?

Two forces drive this transformation. The rise of AI has created unprecedented demand for computational power, and Oracle sees an opportunity to become the backbone of the AI economy. The company is building data centers for AI workloads, partnering with Nvidia and OpenAI to provide massive compute resources for training and inference at scale.

Simultaneously, Oracle is closing a competitive gap with AWS, Microsoft Azure, and Google Cloud. By committing capital beyond its current cash flow, Oracle signals that market share matters more than short-term financial conservatism. The company is sacrificing near-term margins to avoid being left behind in what it sees as a generational opportunity.

The investment community is divided. Bulls see a company making bold moves to compete in the modern cloud landscape, positioning itself as a critical AI infrastructure provider. If the AI boom continues, Oracle's aggressive spending could yield substantial returns.

Bears point to significant risks. Spending 127% of operating cash flow means drawing down reserves or increasing debt, creating financial pressure against rivals with larger balance sheets. Building data centers is expensive, but filling them profitably in a market dominated by established players is harder. If demand doesn't materialize or competition suppresses prices, Oracle could face expensive infrastructure without adequate returns.

Peter Smith

Peter Smith

Peter Smith

Peter Smith