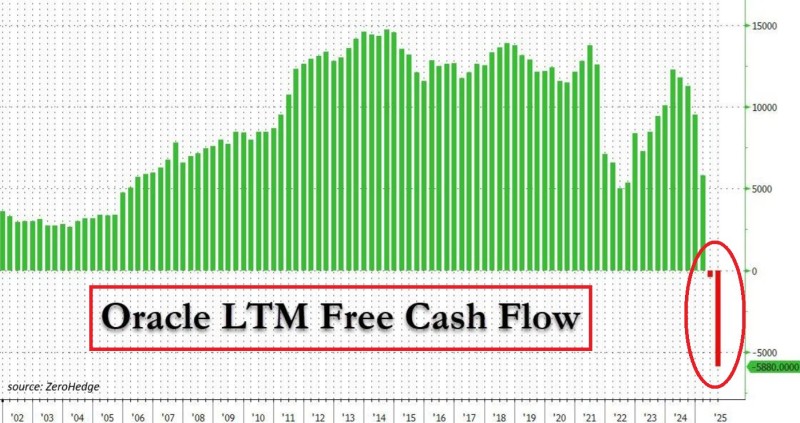

Oracle, traditionally one of the most reliable cash generators in enterprise software, is experiencing its sharpest financial downturn in decades. Recent data reveals a dramatic collapse in free cash flow alongside soaring debt levels, unsettling investors and analysts throughout the tech industry.

A Historic Reversal

For the first time in decades, Oracle's free cash flow has turned deeply negative. After maintaining consistently positive cash generation for over twenty years, the company recorded –$5.9 billion in its last twelve months.

This dramatic shift comes at a particularly challenging moment, as Oracle pushes aggressively into cloud infrastructure and AI services while facing tighter financial conditions across the market.

Key Challenges:

- Free cash flow plunged to –$5.9 billion (lowest in 23+ years)

- Debt-to-equity ratio surged to approximately 520%

- $18 billion in new bonds plus $38 billion in loans recently added

- Negative cash flow limits investment flexibility and shareholder returns

The reversal raises fundamental questions about whether the company's debt-fueled expansion strategy is sustainable, especially given current borrowing costs and competitive pressures from established cloud leaders.

Mounting Debt Creates Systemic Risk

Oracle's capital structure now poses significant risks. With a debt-to-equity ratio around 520%, the company carries far more leverage than its major cloud competitors. This extreme debt load brings real dangers including potential liquidity crunches, refinancing difficulties, and possible credit downgrades if cash generation doesn't stabilize soon.

The recent addition of $18 billion in bonds and $38 billion in loans was intended to accelerate Oracle's cloud expansion and position it for AI-era workloads. However, these investments have significantly increased financial strain precisely when interest rates remain elevated and the economic outlook remains uncertain.

Financial Impact and Strategic Constraints

The consequences of negative free cash flow extend across Oracle's entire operation. The company now has less flexibility to invest in product development, expand cloud infrastructure, or maintain its historical shareholder returns. Some analysts believe Oracle may eventually need to slow capital expenditures or restructure portions of its debt if the cash situation doesn't improve.

An alternative approach might involve focusing more heavily on profitable business segments to offset the losses. Yet this could undermine Oracle's core strategy of aggressively scaling cloud capacity to compete with Amazon, Microsoft, and Google. The company faces a difficult balancing act between immediate financial stability and long-term competitive positioning.

Broader Economic Implications

The severity of this shift cannot be understated. Oracle went from decades of steady cash flow strength to a sudden, sharp decline in just months. As a major employer with significant tax contributions, any prolonged financial instability could ripple outward, affecting employment levels and corporate tax revenues across regions where Oracle maintains substantial operations.

A Critical Juncture

Oracle now stands at a pivotal moment. Its ambitious AI and cloud strategy demands enormous capital investment, but the company is entering a period of financial stress that could severely limit its ability to execute that vision. The upcoming earnings cycles will prove decisive. Either Oracle demonstrates a credible path back to positive cash flow and restores market confidence, or continued deterioration forces strategic shifts that could fundamentally reshape the company's trajectory in the cloud computing era.

The next few quarters will reveal whether Oracle's aggressive expansion bet pays off or whether the financial strain proves too great to sustain its current course.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah