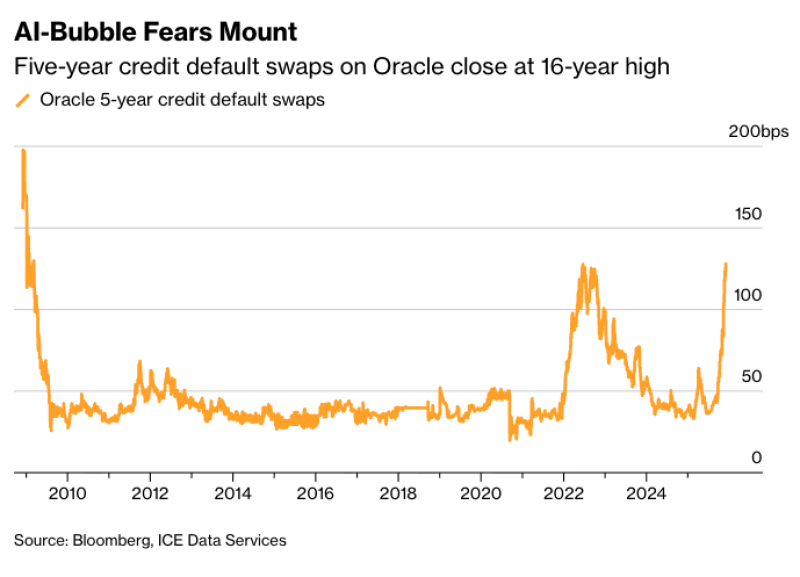

⬤ Oracle faces heavy credit market pressure because the yearly cost to insure its debt keeps rising. Five-year credit default swaps now stand at 1.28 percent, the highest figure recorded since 2009. The sharp increase draws scrutiny at the very moment the company holds a record debt load after a large bond sale. Market data places CDS at a sixteen year peak revealing how quickly investors have reassessed Oracle's credit risk.

⬤ Oracle's total debt now equals about $105 billion following an $18 billion bond issue. Market data show that CDS linked to Oracle's obligations trade with a notional value near $5 billion. The annual cost of protection has climbed more than threefold since June, a sign that credit concerns are deepening. Investors question whether heavy AI-infrastructure spending and large capital requirements are driving technology companies toward risky leverage levels. Spreads have leapt from multi year lows to territory last seen during the financial crisis.

⬤ The surge arrives as doubts intensify over whether AI-related expenditure is running beyond control. Oracle has taken a leading role in constructing AI data centres and expanding cloud infrastructure, projects that consume large amounts of cash. While the firm continues to enlarge its enterprise cloud business, the rising cost of debt signals that lenders have grown uneasy and demand richer rewards for bearing risk. The widening of Oracle's spreads fits a broader pattern of credit spreads expanding across the technology sector.

⬤ The sharp rise in Oracle's CDS carries weight because it reveals the credit backdrop for large technology companies that raise billions in the debt markets. Higher protection costs may alter how those firms deploy capital, refinance existing obligations and plan future AI investment. With Oracle's debt now priced at risk levels last observed more than ten years ago, the credit market is sending an unambiguous warning as leverage continues to mount.

Usman Salis

Usman Salis

Usman Salis

Usman Salis