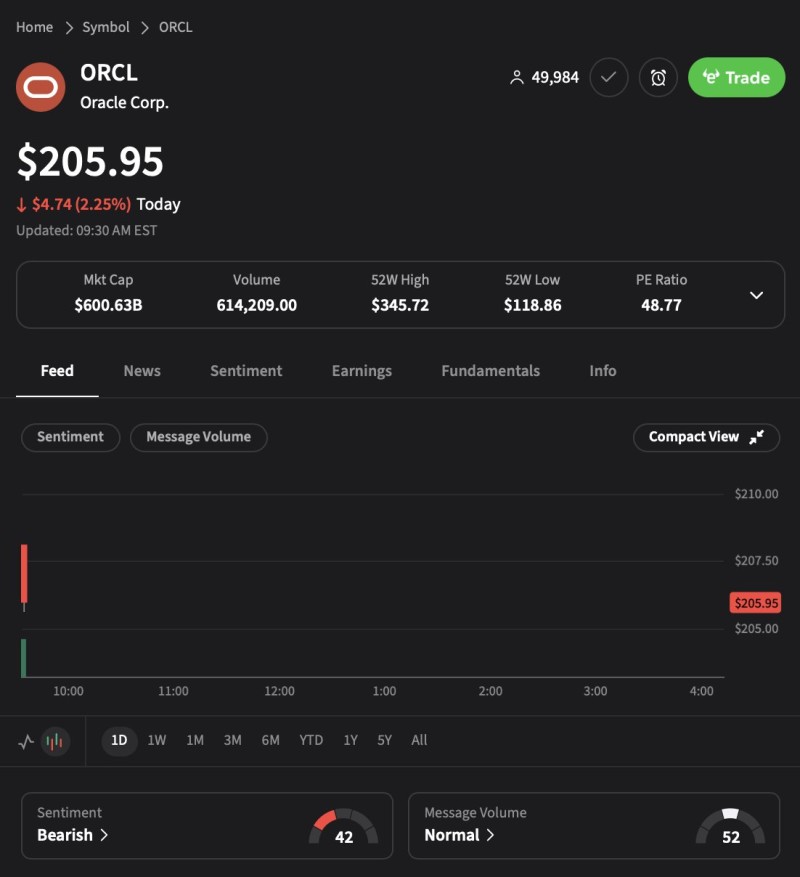

⬤ Oracle Corp. continued sliding Thursday, inching toward the closely watched $200 support level. The stock traded at $205.95 at 9:30 AM EST, down 2.25% for the day, with market sentiment turning bearish. Trading commentary noted ORCL is "getting close to cracking below $200," highlighting mounting pressure after several weak sessions.

⬤ With a market cap of $600.63 billion and early volume of 614,209 shares, Oracle sits far below its 52-week high of $345.72 but remains well above its $118.86 low. The intraday chart showed consistent downward drift without any meaningful bounce, matching the recent multi-session downtrend. Sentiment metrics registered a bearish score of 42 with normal message volume, suggesting soft conviction rather than panic selling.

⬤ This decline follows Oracle's strong performance earlier this year, with morning session charts showing sellers firmly in control and keeping shares capped below $207. The stock's elevated P/E ratio of 48.77 may be amplifying market sensitivity as it approaches the $200 psychological threshold, making valuation a focal point for concerned investors.

⬤ The $200 level matters because round-number zones often serve as key sentiment markers. Breaking decisively below this point could shift perceptions on valuation strength, risk appetite, and momentum across large-cap tech stocks. With bearish sentiment climbing and intraday pressure building, how Oracle behaves at this level will likely shape near-term trading expectations.

Usman Salis

Usman Salis

Usman Salis

Usman Salis