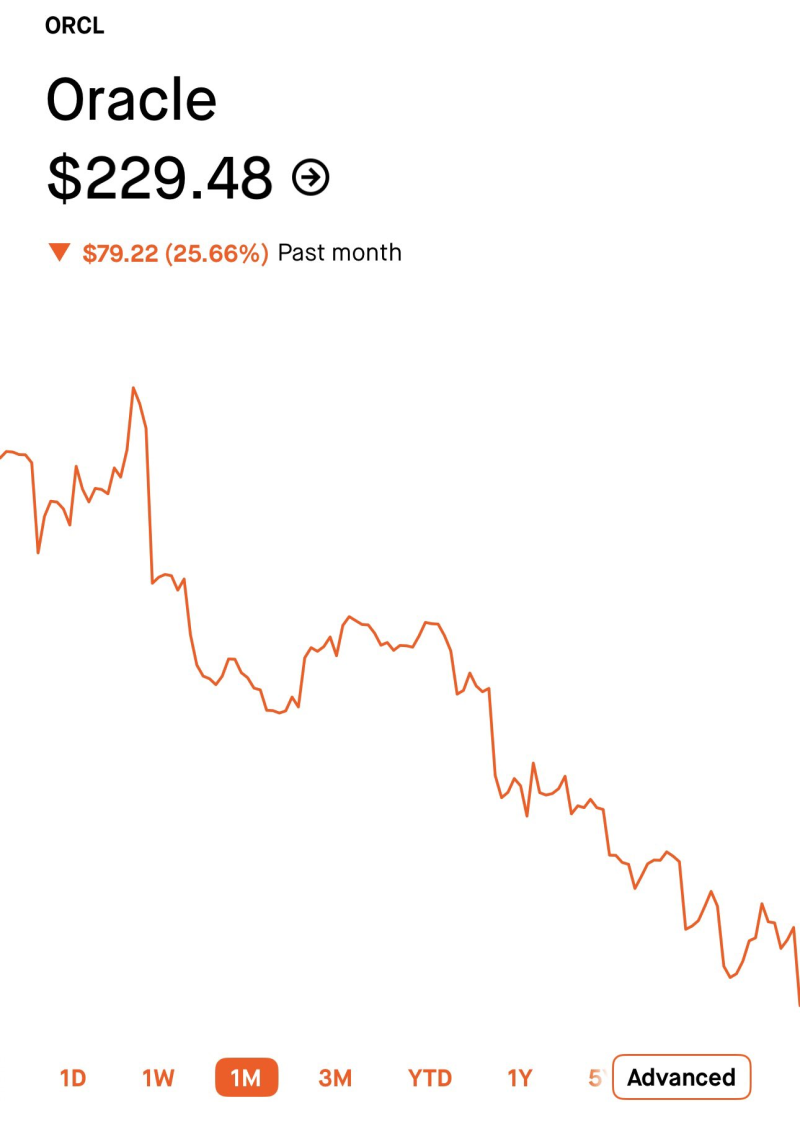

⬤ Oracle's stock has fallen roughly 25.66% to $229.48 in the past month. The sharp decline has put a spotlight on the company's cloud execution, corporate spending patterns, and growing competition from faster-moving AI and infrastructure players.

⬤ Federal tax policy discussions add fresh uncertainty for enterprise software companies like Oracle that rely on steady IT budgets and multi-year cloud deals. Potential corporate tax increases and tighter deduction limits could squeeze customer spending and push talent toward regions with lower tax burdens—adding pressure on top of rising costs and fierce competition.

⬤ The 25%+ drop signals more than typical market noise. It ranks Oracle among the weakest large-cap tech performers this month, prompting investors to rethink valuations across software and cloud stocks amid softer earnings and evolving AI infrastructure trends.

⬤ With the stock hovering near short-term support levels, traders are split on whether this is a temporary pullback or the beginning of a deeper revaluation. While Oracle keeps investing in cloud and AI infrastructure, the recent selloff forces tough questions about execution, profitability, and competitive edge in a rapidly changing landscape.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova