One chart tells the story of 50 years in computing. What it shows is nothing short of a power shift: after decades of Intel ruling the chip world, NVIDIA's revenue has not just caught up—it's blown past. This is more than a corporate milestone. It's a signal that the computing era defined by CPUs is giving way to something new: the age of GPUs and AI.

Chart Overview: From Intel's Empire to NVIDIA's Takeoff

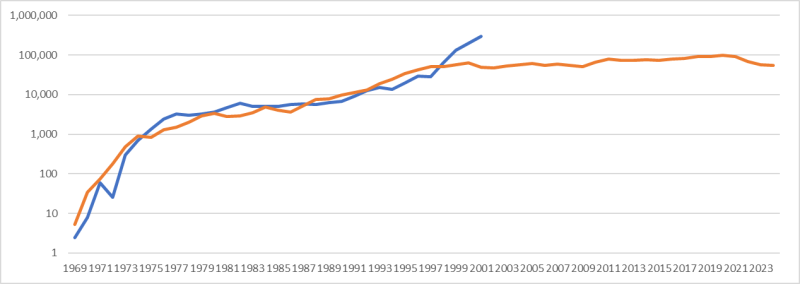

Shared by Martin Shkreli and dubbed "the best chart I've ever made," this visualization tracks the inflation-adjusted revenues of NVIDIA (NVDA)and Intel from their founding through 2023. The logarithmic chart plots both companies' inflation-adjusted revenue over time, capturing the full arc of the semiconductor revolution—from microprocessors to machine learning.

Intel's Early Reign (1970s–1990s): Intel (orange line) dominates from day one. Its microprocessor invention powers the PC boom, giving the company a near-monopoly on CPUs for desktops and servers. Throughout the '70s, '80s, and '90s, Intel's revenue climbs exponentially—a visual testament to its stranglehold on computing.

NVIDIA's Entry (1990s–2000s): NVIDIA (blue line) enters the scene in the late '90s, growing steadily but staying far behind Intel. It carves out a niche in gaming and graphics hardware, gradually proving that GPUs matter beyond just rendering pixels.

The Inflection Point (2018–2023): Around 2018, something changes. NVIDIA's line shoots upward while Intel's flattens. By 2023, the two lines cross—NVIDIA overtakes Intel in inflation-adjusted revenue for the first time in history. This isn't just about numbers. It's about what powers the future of computing: AI, data centers, and parallel processing—all NVIDIA territory.

- The AI Catalyst: NVIDIA's surge mirrors the explosion in AI infrastructure. Its GPUs have become essential for training large language models, running generative AI, and powering data centers—the new backbone of the digital economy.

- Intel's Plateau: Intel's momentum stalls after 2000. Manufacturing delays, leadership churn, and missed opportunities in AI have left the company struggling to adapt. Its reliance on CPUs has limited its exposure to the fastest-growing segment of tech.

- The Power of Pivoting: NVIDIA's rise shows what happens when a company shifts early—from gaming to AI, from consumer hardware to enterprise infrastructure. That adaptability turned a graphics card maker into a trillion-dollar giant.

- Exponential Growth in Context: The chart's logarithmic scale (1 to 1,000,000) highlights just how explosive NVIDIA's recent growth has been—one of the fastest revenue surges in tech history.

Historical Context: A Changing of the Guard

For 50 years, Intel's chips ran the world. From early desktops to massive server farms, "Intel Inside" was synonymous with computing power. But this chart captures a fundamental shift: the era of central processing (CPUs) is making way for parallel computing (GPUs).

NVIDIA's processors now power the AI ecosystem—from ChatGPT to self-driving cars. It's a transition that echoes past industrial revolutions: the tools of one era become the foundation of the next.

NVIDIA's Momentum: NVIDIA's growth isn't just financial success—it reflects structural demand driven by AI. With a valuation surpassing $2 trillion in 2024, the market is betting big on this shift continuing.

Intel's Uphill Battle: Intel's new leadership has promised a turnaround—rebuilding its manufacturing and pushing into AI chips. But the revenue plateau on this chart shows just how steep that climb will be. Intel now faces the same test its competitors once did: evolve or become irrelevant.

A Broader Shift: This chart symbolizes more than corporate rivalry. It marks a geopolitical and industrial realignment where leadership in silicon depends less on manufacturing muscle and more on architectural innovation and AI scalability.

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets