NVIDIA's rise has been nothing short of extraordinary. Since April, the AI chipmaker has created $2.5 trillion in shareholder wealth—outpacing what Bitcoin achieved in its entire 15-year existence.

The Numbers Behind the Surge

As Joe Weisenthal pointed out, this comparison highlights how the AI revolution is rewriting the rules of wealth creation at breakneck speed. While Bitcoin took over a decade to reach $2 trillion, NVIDIA did more than that in less than a year.

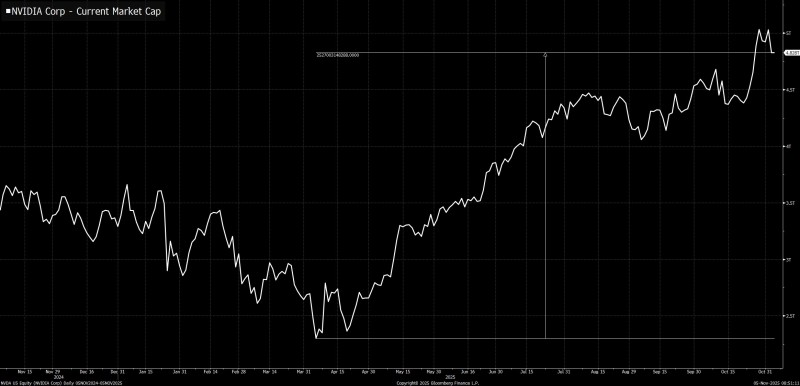

According to Bloomberg data, NVIDIA's market cap now stands near $4.83 trillion, nearly doubling from around $2.3 trillion in April 2025. The chart shows an almost parabolic climb—one of the most sustained rallies in corporate history. The stock accelerated sharply from mid-April through July, briefly consolidated in August and September, then pushed toward the $5 trillion mark.

What's driving this insane growth? A few key factors:

- AI compute demand – NVIDIA's GPUs power virtually every major AI model from OpenAI to Google to Anthropic

- Data center explosion – Data center revenue now dwarfs gaming and keeps breaking records

- Product edge – Next-gen chips like Blackwell and Rubin promise even better performance

- Limited competition – Few rivals can match NVIDIA's advanced GPU manufacturing capabilities

Why This Matters

NVIDIA's trajectory isn't just about one company getting rich. It signals a fundamental shift in how the global economy values technology. Compute power has become the new oil—a strategic asset driving corporate profits, national policy, and infrastructure investment. Where past decades belonged to software and mobile, this one belongs to AI—and NVIDIA is sitting right at the center of it all. If momentum continues, NVIDIA could soon rival Apple and Microsoft as the world's most valuable company.

Peter Smith

Peter Smith

Peter Smith

Peter Smith