NVIDIA had a rough day. News broke that Michael Burry—the investor famous for predicting the 2008 housing crash—has taken a short position against the AI chip giant, and the stock tumbled more than $120 billion in market value. But here's the twist: retail investors aren't worried.

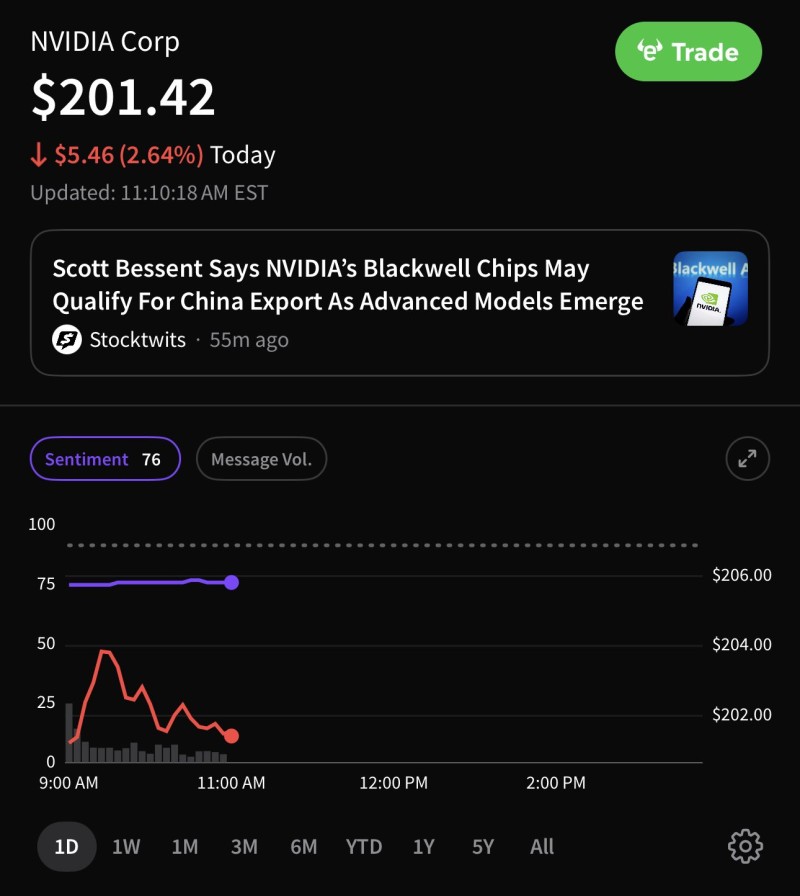

What the Chart Shows

According to Stocktwits, NVIDIA's sentiment score sits at 76, firmly in "Extremely Bullish" territory. It's a fascinating split—Wall Street's getting cautious while everyday traders are loading up on the dip.

NVIDIA opened near $206 and steadily slid to around $201.42 by late morning, losing 2.64%. The decline wasn't marked by panic-driven volume spikes—more like steady institutional profit-taking. Despite the drop, Stocktwits sentiment stayed rock solid at 76, suggesting retail traders see this as a buying opportunity rather than a red flag. Some are betting on positive news around NVIDIA's Blackwell chips potentially getting export approval for China, which could open up new revenue streams down the line.

Why Did NVIDIA Fall?

A few things came together today:

- Burry's short position added psychological pressure to an already jittery tech market

- Profit-taking after NVIDIA's massive 2025 rally—people are booking gains

- Valuation concerns—even after the drop, NVIDIA trades at a premium compared to most large caps

- Mixed signals—optimism about China export approvals clashed with broader market uncertainty

That said, NVIDIA's fundamentals haven't changed. The company still dominates AI chips, and demand for its GPUs in data centers and high-performance computing keeps growing. For now, it's a standoff between cautious institutions and confident retail investors—and the next few sessions will show who's reading the room right.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah