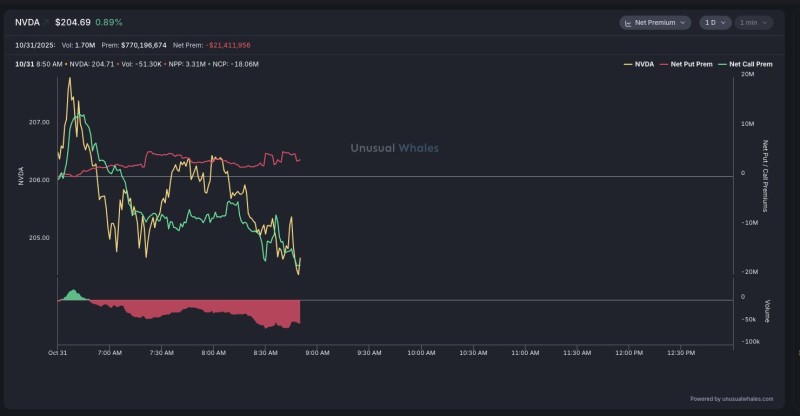

Nvidia (NVDA) ticked up 0.89% to $204.69 on Thursday, but beneath the surface, options traders were telling a different story. While the stock gained ground, the flow of money in the options market suggested growing caution. Net premiums tilted negative by $21.4 million, hinting that big players might be bracing for some turbulence ahead rather than betting on continued gains.

Traders Pump the Brakes on Call Options

According to data from unusual_whales trader, Nvidia's call premiums steadily dropped throughout the morning session, while put premiums held steady or even climbed slightly.

This divergence is worth paying attention to: it means traders were either taking profits on bullish positions or actively hedging against potential downside, buying puts to protect against a pullback, selling calls to cap their upside exposure, or both. Trading volume stayed strong with 1.7 million contracts changing hands and total premiums hovering around $770 million. Meanwhile, the stock itself showed early strength near $207 before retreating toward $205 by day's end, reflecting some mild selling pressure as the session wore on.

AI Enthusiasm Meets Real-World Headwinds

Nvidia is still the undisputed heavyweight in AI chips and GPU manufacturing, but investors have gotten pickier after months of explosive rallies. Recent noise around supply chain issues, export restrictions targeting advanced chips, and intensifying global competition has injected some volatility into the stock. That said, excitement remains high for Nvidia's next-generation Blackwell GPUs and its expanding footprint in AI data centers, both of which are expected to drive serious growth through 2026. The broader market hasn't helped either, with rising Treasury yields and a more cautious tone across tech stocks keeping risk appetite in check.

All Eyes on the $200 Support Level

Even with the defensive positioning in options markets right now, Nvidia's long-term story hasn't changed. If buyers step back in around the $200 to $202 range, the stock could find its footing ahead of earnings reports and fresh AI infrastructure announcements. But if negative premium flow continues, it might signal that traders expect more sideways action or even a mild pullback before the next big move higher.

Alex Dudov

Alex Dudov

Alex Dudov

Alex Dudov