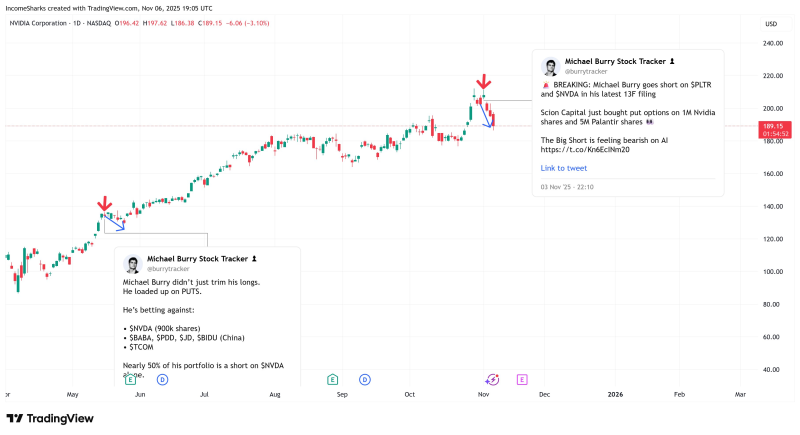

● A recent comment from IncomeSharks raised questions about whether Michael Burry's bearish bet on Nvidia will finally work out, or if he'll be "right for a week, then get crushed" again. The analyst pointed out how tough it is to short high-momentum stocks, noting Burry is "probably still at a loss overall from shorting it in May" and reminding followers that "early is still wrong." The TradingView chart shows Nvidia pulling back from recent highs, with red arrows marking both Burry's earlier short and the current decline.

● Meanwhile, proposed tax changes targeting energy-intensive AI operations are adding uncertainty. Though not aimed specifically at Nvidia, these policies could hurt the broader ecosystem: smaller compute companies might fail, GPU research could shrink, and talent may leave for friendlier markets. Since Nvidia powers much of AI infrastructure, these pressures could indirectly affect NVDA stock.

● Timing is everything. Even solid bearish logic struggles against fast-moving markets and shifting regulations, making shorts risky. The chart shows Nvidia's pullback, but the stock still trades well above where Burry reportedly entered his earlier positions.

● Between NVDA's price swings, high-profile short bets, and regulatory uncertainty, traders are proceeding carefully. Nvidia remains central to discussions about timing, risk, and unpredictability in today's tech market.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi