NVIDIA has become the poster child for the AI revolution, and its stock is acting like it. The chipmaker's shares are pushing toward new highs again, with traders eyeing a clean break above $200.

NVDA Chart Breakdown: Bulls Still in Control

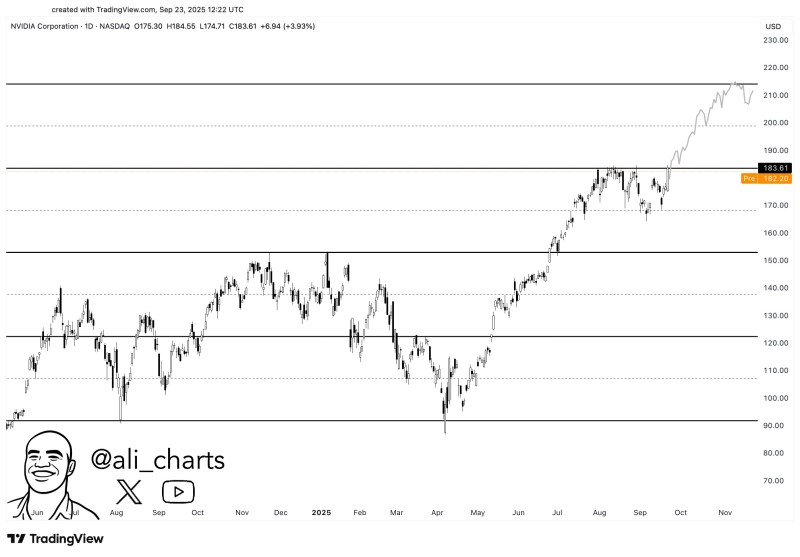

Technical analyst Ali recently highlighted how NVDA's breakout pattern remains rock-solid, with bulls loading up for the next leg higher. As AI demand continues to drive Wall Street's excitement, NVIDIA has turned into the ultimate tech momentum play.

The daily chart tells a clear story of sustained buying pressure. NVDA closed at $183.61, jumping nearly 4% and showing fresh institutional interest. Key support levels at $150 and $170 are holding strong, giving the rally a solid foundation. The next big hurdle sits right at $200, with potential for a stretch toward $210-$220 if buying momentum keeps up. The chart pattern suggests a typical strong-trending stock behavior: climb to $210, minor pullback, then another push higher.

What's Fueling This Rally?

NVIDIA's dominance in AI hardware is the main story here. The company's GPUs power everything from massive data centers to the latest AI models, and demand is still crushing supply. That gives them serious pricing power in a market where everyone wants their chips. Recent earnings blew past expectations, with data center revenue absolutely surging. Analysts keep raising their price targets as a result. The broader tech rally, helped by cooling inflation fears, has lifted the entire sector, but NVIDIA is leading the charge.

Not everything's perfect though. Valuation concerns are real - the stock has already run hard this year, and some investors think it's getting overheated. Any surprise from the Fed or weakness in global demand could hit high-growth names like NVDA first. Plus, competition is heating up as AMD and Intel pour money into AI chip development, trying to grab some of NVIDIA's market share.

Peter Smith

Peter Smith

Peter Smith

Peter Smith