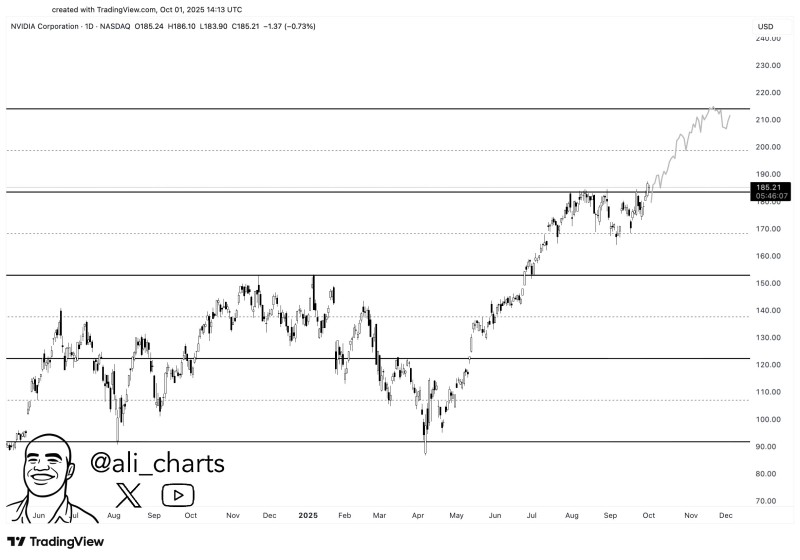

NVIDIA has emerged as the cornerstone of the AI-powered market rally, bouncing back from earlier turbulence to reach fresh highs. Traders are now zeroing in on the $200 level—a key psychological threshold that could define the stock's next move.

Key Technical Levels

Chart analysis from Ali suggests this round number may act as a near-term magnet for price action.

Current Setup:

- Trading around $185 with solid support at $175

- Strong uptrend in place since April 2025 rebound from $105 lows

- $200 projected as next magnetic target

- Resistance beyond that sits near $220

- Downside cushion remains in the $160–$170 zone

What's Driving the Rally

NVIDIA's climb isn't just technical—it's rooted in real business momentum. The company dominates AI computing with its GPUs powering data centers and generative AI platforms. Recent earnings have crushed expectations as data center chip demand surges. Institutional investors keep buying the dips, treating NVDA as a core tech holding. The stock has become a market bellwether, often setting the tone for the entire semiconductor sector.

All eyes are on $200. A clean break above this level could spark momentum buying and open the door to $220. But if the rally stalls, we might see a pullback to the $175–$180 range where buyers have consistently stepped in. Either way, NVIDIA's AI dominance suggests the long-term trend remains intact.

The question now: will $200 launch the next leg higher, or will profit-taking cool things down? For a stock at the center of the AI revolution, the bigger picture still looks bullish.

Usman Salis

Usman Salis

Usman Salis

Usman Salis