NVIDIA market capitalization now stands at a staggering 16% of the U.S. gross domestic product—a milestone no company has ever reached in modern financial history. This jaw-dropping figure reflects how deeply artificial intelligence has transformed not just tech valuations, but the entire structure of the global economy. The chipmaker's rise from a niche graphics card manufacturer to an economy-scale powerhouse happened in less than three years, driven by explosive demand for AI compute infrastructure.

NVIDIA's Historic Valuation Puts It in a League of Its Own

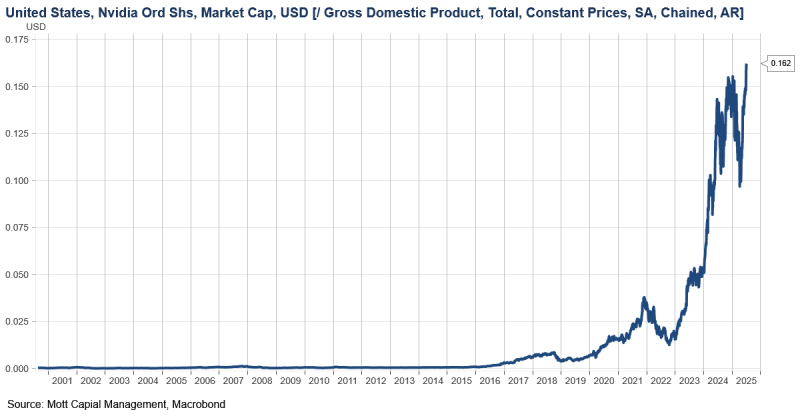

A chart shared by Stock Sharks, using data from Mott Capital Management and Macrobond, shows NVIDIA's market cap now equals roughly 16% of U.S. GDP.

That's not just a big number—it's a structural shift. The company has become more than the world's leading chipmaker; it's now one of the most economically significant corporations ever recorded. Its influence on the S&P 500 and broader U.S. markets rivals entire industries combined.

Chart Analysis: A Decade of Unprecedented Growth

The data tells a striking story. From 2000 through 2019, NVIDIA's market cap relative to GDP barely registered—hovering near zero for almost two decades. Then, starting in 2020, everything changed. The line on the chart turns sharply upward as AI went from buzzword to economic force, with NVIDIA supplying the hardware backbone for nearly every major AI system on the planet.

By 2023, the curve goes parabolic. NVIDIA's share of U.S. GDP rockets from under 2% to over 16% in less than three years. Even during pullbacks, the trajectory stayed bullish—each dip followed by an even steeper rally. The latest reading of 16.2% reflects a level of valuation concentration that has no modern precedent, eclipsing even the dot-com boom peaks.

What's Driving This Surge?

Three forces are behind NVIDIA's meteoric rise:

- AI hardware dominance: NVIDIA's GPUs run nearly every large-scale AI model in production, giving it a near-monopoly in AI infrastructure.

- Data center explosion: Global demand for cloud compute and generative AI clusters has driven record quarterly revenues quarter after quarter.

- Investor conviction: NVIDIA has become the go-to asset for anyone wanting exposure to what's being called the "AI supercycle," cementing its valuation premium.

Together, these dynamics have turned NVIDIA into what some analysts are calling the new oil of the digital age—a company whose chips define how fast the world innovates.

One Company, Economy-Sized Value

When a single company's valuation approaches a fifth of the entire U.S. economy, it raises big questions about concentration risk, systemic exposure, and whether these multiples can hold. Stock Sharks described the moment as one where "corporate innovation begins to rival national-scale growth." That's not an exaggeration. NVIDIA's valuation growth mirrors the broader shift from industrial economies to AI-driven ones, where compute power is now the main driver of productivity gains.

A Defining Moment for the AI Era

NVIDIA hitting 16% of U.S. GDP isn't just a financial milestone—it's a signal of how radically artificial intelligence is reshaping the global economy. Whether this valuation proves sustainable depends on NVIDIA holding its technological edge as competition heats up from AMD, Intel, and custom chip developers building their own AI hardware.

For now, though, NVIDIA stands alone as a historic outlier—a company whose market value has crossed from industry leader into the realm of macroeconomic force.

Usman Salis

Usman Salis

Usman Salis

Usman Salis