Insider activity can offer valuable clues for investors, particularly at a company as pivotal as Nvidia. Recent SEC filings show that CEO Jensen Huang has been methodically selling large blocks of stock, triggering debate on Wall Street. Is this simply standard financial planning, or does it hint at concerns about Nvidia's stretched valuation?

Steady Pattern of Insider Sales

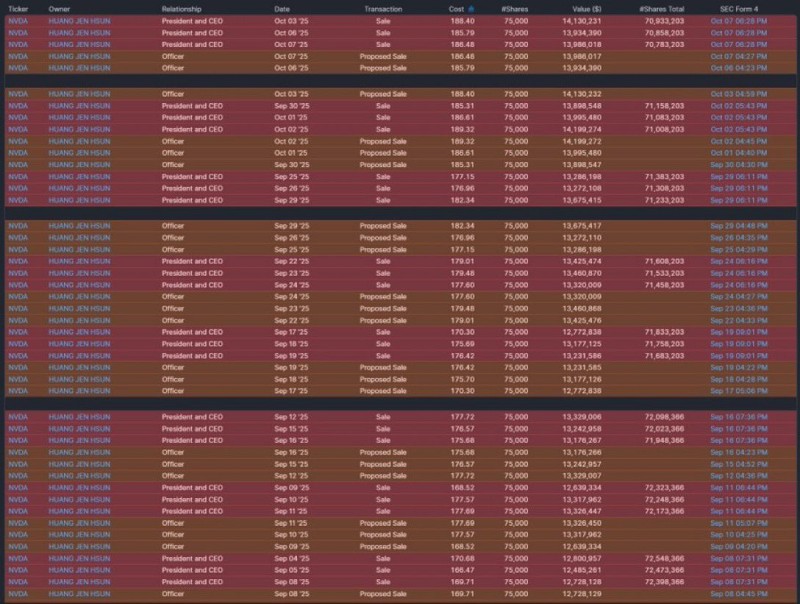

Huang has been offloading 75,000 shares at a time, with trades happening nearly every week. As trader Ted pointed out in a recent tweet, these transactions occurred at prices between $170 and $188 per share from mid-September through early October 2025. Each sale brought in over $13 million, pushing total insider selling well into the hundreds of millions within weeks. While Huang maintains a substantial position, the regularity of these transactions has investors paying close attention.

The filings reveal a structured approach: identical 75,000-share blocks sold regardless of market swings. This points to a pre-scheduled trading plan, though the timing - while Nvidia hovers near record highs - adds significance. From a technical standpoint, the stock has been riding a powerful uptrend, recently pushing past key moving averages. Some view these sales as smart profit-taking, while others see them as suggesting limited near-term upside.

What This Means for Investors

Insider selling isn't inherently bearish. Executives sell for various reasons: taxes, diversification, personal financial planning. But when it's this frequent and involves the CEO of one of the world's most valuable tech companies, it carries more weight. The pattern is notable for three reasons:

- Frequency: Nearly weekly transactions

- Scale: Each sale worth approximately $13–14 million

- Backdrop: Nvidia commands a premium valuation driven by AI growth expectations

Nvidia remains the dominant force in AI hardware, with surging demand from data centers and companies developing generative AI solutions. Still, as competitors like AMD and Intel advance their offerings, investors are watching whether Nvidia can sustain its remarkable growth trajectory. Persistent insider sales could dampen sentiment, even if the underlying business stays robust.

Peter Smith

Peter Smith

Peter Smith

Peter Smith